Cashfree turns 10! Celebrate with 1.6%* gateway fee for new merchants – limited period!

Instant Settlements

Payment Gateway settlements

within seconds. Opt from a wide range of settlement options and never run out of funds.Super-fast settlements

Highly reliable

Tailor-made for you

Instant Settlements

Instant Settlements Payment Gateway

, you can:Receive steady inflow of funds

Instantly reconcile all your payments

On-Demand Instant settlements

Withdraw your balance to your bank account in a single click, when you need it the most.

Scheduled Instant Settlements

Access customer payments in the blink of an eye. Cashfree settles payments multiple times a day, starting from intervals of 15 minutes, even on bank holidays.

Effectively manage your daily operations. Get all your settlements at the start of your day at 9 am and when you close your books at 5 pm.

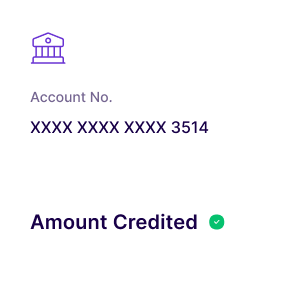

Get instant fund transfer straight to your bank account.

Get your customer payments settled straight into your virtual account. Use virtual account funds to pay money to your vendors, do customer refunds, and disburse loans.

PRICING

Custom pricing designed for enterprises

Early access to new features

Dedicated account manager

Discounted pricing

Support over WhatsApp in addition to other channels

Get in touch with our sales team to explore the right product(s) for your payment needs and get custom pricing.

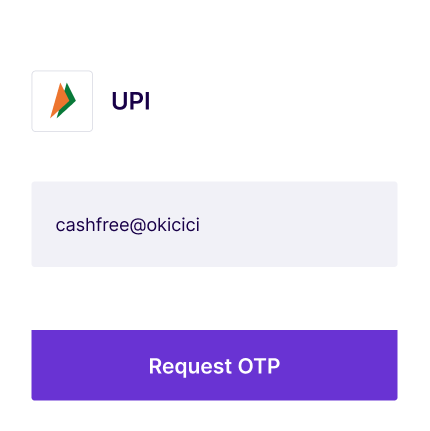

Customer enters the payment details in Cashfree’s checkout forms

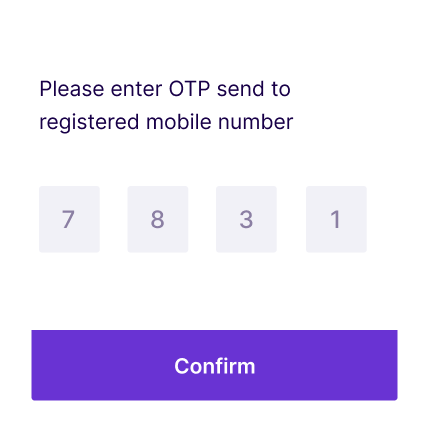

The transaction is authenticated by the customer using OTP verification

The amount is received at Cashfree’s acquiring banks

Amount is credited in merchant’s account in T+2* days after payment gateway deductions.

Cashfree Payments credits the merchant’s accounts instantly after Payment Gateway deduction

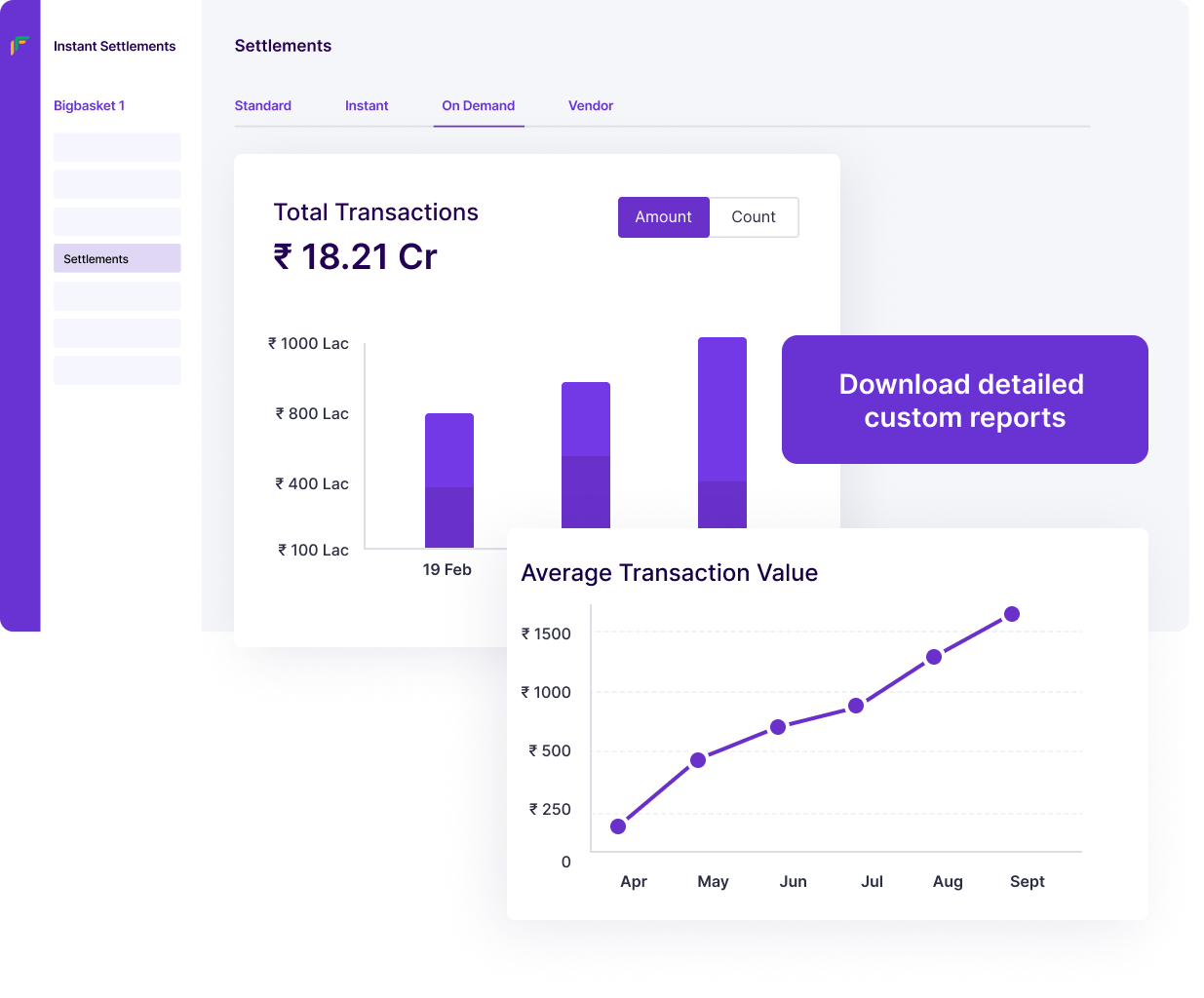

View and download daily, weekly, and monthly reports or generate custom reports.

Understand business cash flow better through detailed reports on payments, settlements, refunds, settlement reconciliation, etc.

Analyze settlement status with easy-to-read graphs and downloadable custom reports through email, dashboard view, or SFTP.

Customized Checkout

Customize the checkout page to look like your website or mobile application.

Token Vault

Process saved card payments securely with India’s first interoperable card tokenization solution.

Learn MorePre-authorization

Block funds when your customer places an order. If the order is modified or canceled within a week, process the refund instantly without any extra charge.

Learn MoreHigher than Industry Success Rate

With smart dynamic rerouting between multiple bank payment gateways, experience the highest success rate every time.

Real-time Reconciliation

Know the real-time status of all customer payments and avoid ambiguity with real-time reconciliation.

Payment Links

No-code payment links to collect payments over WhatsApp, SMS, Facebook, Twitter and other channels

Learn MoreSubscriptions

Accept recurring payments by auto-debiting customers’ accounts via standing instructions on card, e-mandate via net banking option or UPI AutoPay.

Learn MoreAutoCollect

Collect and reconcile IMPS/NEFT/UPI payments using unique virtual accounts and UPI IDs.

Learn More* Settlement cycle is subject to bank approval and can vary based on transaction type, business category/model, risk parameters and other factors.

Ready to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access