Go global effortlessly! Accept payments in over 100 currencies from customers worldwide.Learn more

Verification Suite

KYC Verification

SuiteKYC verification solution

for your business. Automate user orvendor KYC

and eliminate fraud using an updated database in real-time using powerful APIs.bulk KYC verification

24*7 real-time verification

69% less onboarding drop-off

5 sec-authentication

Identity Verification

KYC Verification Suite

into your product and verify the identity of your users or partners in real-time during onboarding, before making payouts or disbursing refunds.Bank Account Verification

Verify users before account opening or during onboarding KYC

Verify users as a part of refunds redemption flow

Verify before making Payouts or disbursing loans

UPI ID Verification

IFSC Verification

PAN Verification

Verify the PAN type

Match the name as per NSDL database

Verify if Aadhaar is liked to the PAN

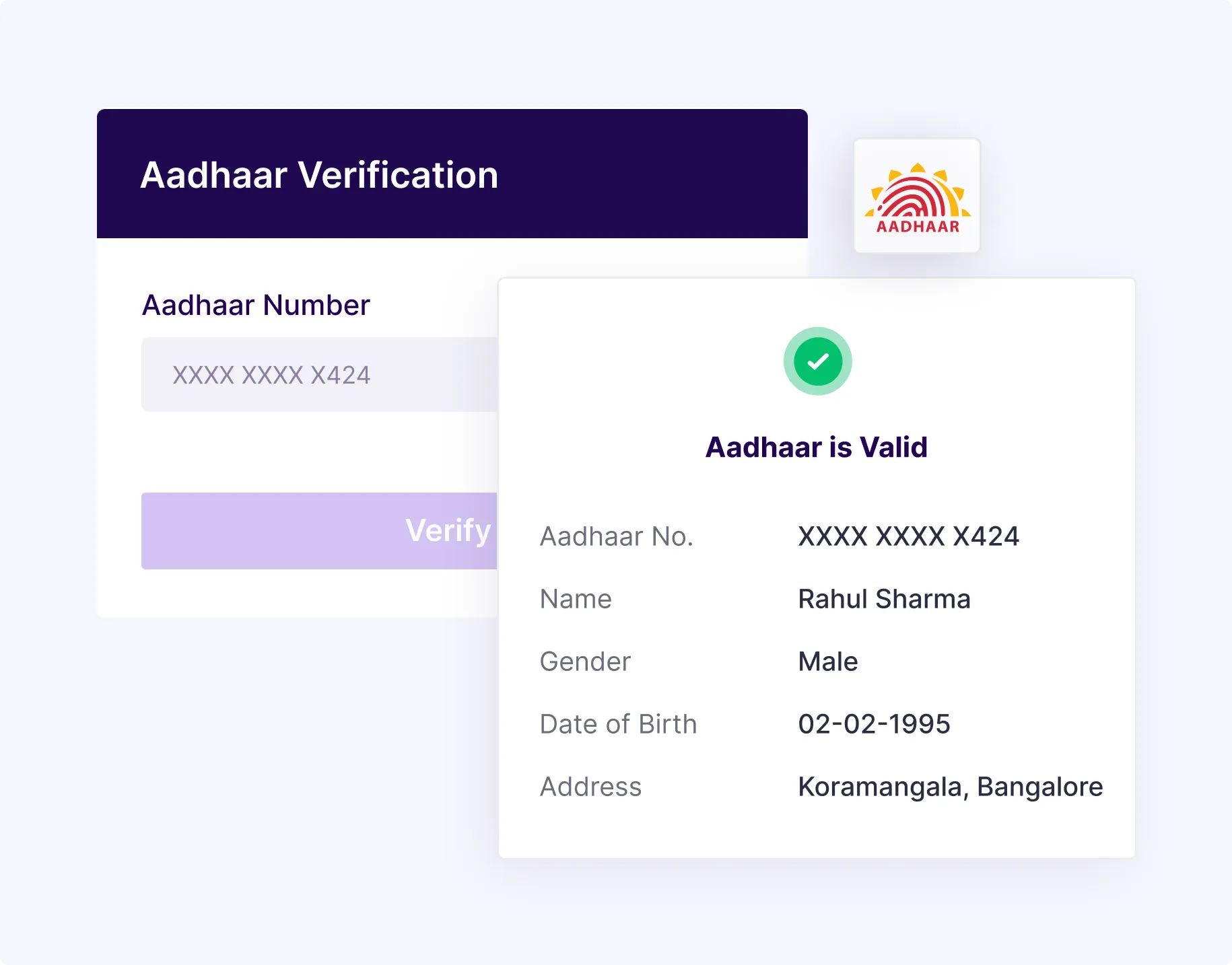

Aadhaar Verification

Get user’s consent by enabling OTP-based Verification

Verify address

Match name as per UIDAI records

With Aadhar OCR extract data from Aadhaar cards instantly. Use API to auto-fill this data in the correct fields for a quicker & errorless form-filling experience

GSTIN Verification

Verify registered business address

Match name as per GSTIN records

Ensure accurate ITC claim everytime

KYC Verification Suite

by Cashfree Payments?Use cases for various industries

Verification Suite

for innovative businessesTop businesses across industries trust Cashfree Payments' Verification Suite

Instant KYC Verification

KYC verification

5 Lakh+ API calls per day

85% reduction in operational time

75% reduction in operational cost

KYC Verification API

with your product/app. Ensure no drop-off with faster verification.Identity Verification

KYC Verification API

Verify sensitive user information with highly reliable and secure APIs

Supports Sync and Async program

Use the official Cashfree Payments libraries for different programming languages to integrate with your product and automate the verification flow

Get notified on single or bulk verification status in real-time via webhooks

const cfSdk = require('cashfree-sdk');

const {Validation} = cfSdk.Payouts;

const response = await Validation.ValidateBulkBankActivation({

bulkValidationId : "testis1",

entries : [

{ name: "John Doe",

bankAccount : "1007766300076281" ,

ifsc : "HDFC0001007",

phone : "9876553210",

}

],

}];

Have more questions?

Visit our support pageOn Cashfree Payments, you can instantly verify Bank Account Number, UPI ID, IFSC, PAN, etc. As you submit the request, our API gives an instant response.

No, there is no such limit. You can use the feature to verify any number of accounts in a day, 24*7.

While onboarding users, vendors, delivery partners, or even employees, an organization needs to do a Bank Account check. Minimize the chance of exposing the data to any third party, integrate Bank Account Verification API with the company’s internal systems and automated the process.

The capability to verify a/c can be used in multiple business scenarios such as

- Employee background Verification: a recruitment agency can use the feature for a candidate's background check.

- Vendor onboarding: a marketplace splitting commission with different vendors can use the feature to verify the bank account, PAN or other details at the time of onboarding a vendor. This also helps in making accurate payments later on. The ability to integrate the API with existing ERP helps reduce operational effort while saving costs.

Yes, Payouts users can integrate the Verification Suite to avail this feature.

Yes, if you are using Cashfree marketplace settlement and want to use identity verification API as well, you need to opt for the feature separately. Our experts will help you with the integration and you will be able to use Cashfree marketplace settlement and verification features together.

The verification can be done for 600+ recognized Indian banks including all public banks, private banks, and 126+ co-operative banks*.

Note: Verification may not be possible for some co-operative bank a/cs.

The data is directly fetched from the updated government databases, hence is highly reliable/accurate.

Have more questions?

Visit our support pageCashgram

Payout links enable you to send money without the receiver’s bank account details or UPI ID, Verify the beneficiaries' details to ensure money is credited to intended beneficiaries only.

Learn MoreEasy Split

Verify and onboard vendors, collect payments from customers, deduct commissions, and split payments between vendors or your own bank accounts.

Learn MorePayment Gateway

Collect payments on your website or app. Verify account details before doing customer refund.

Learn MoreReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access