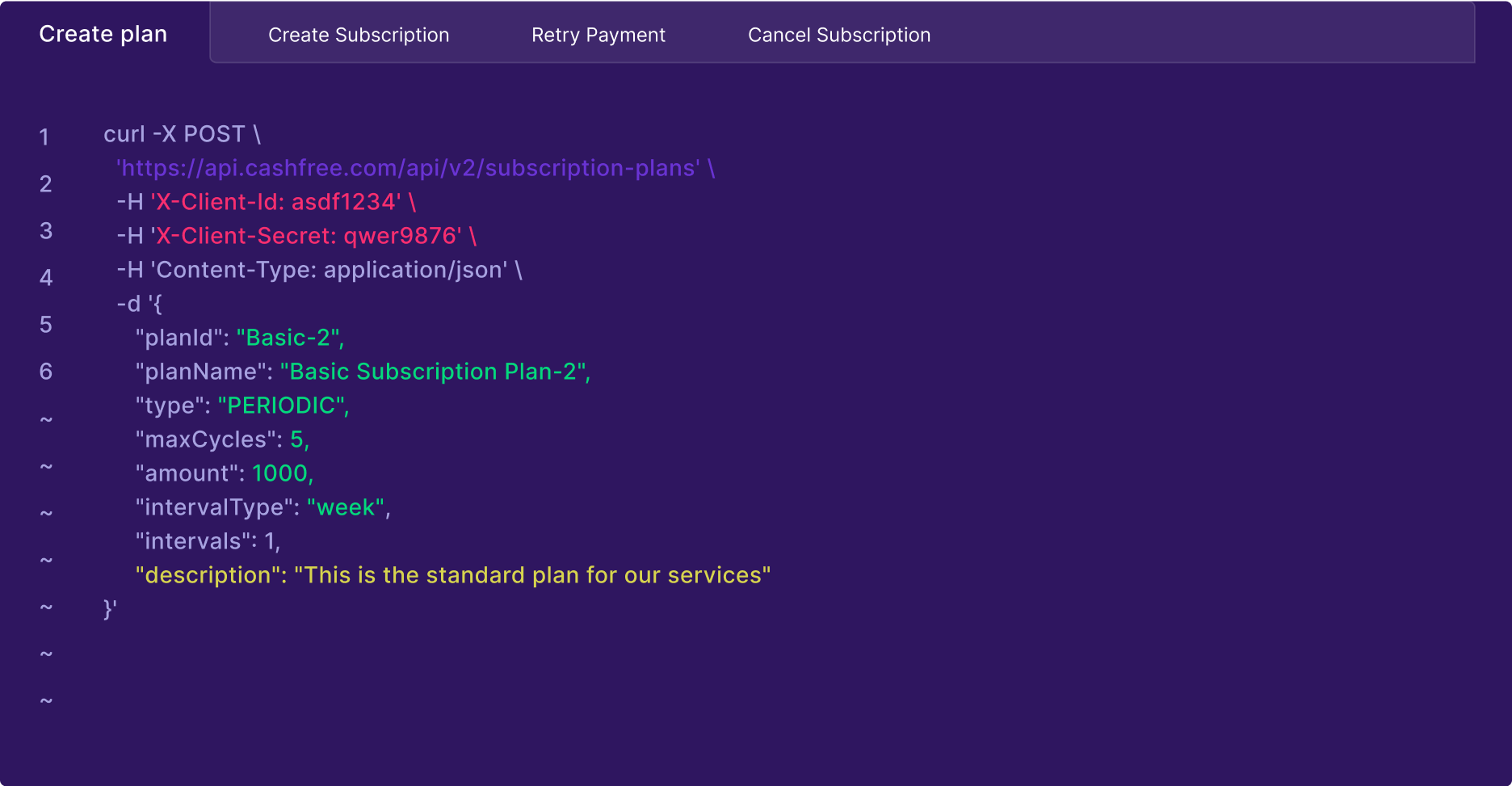

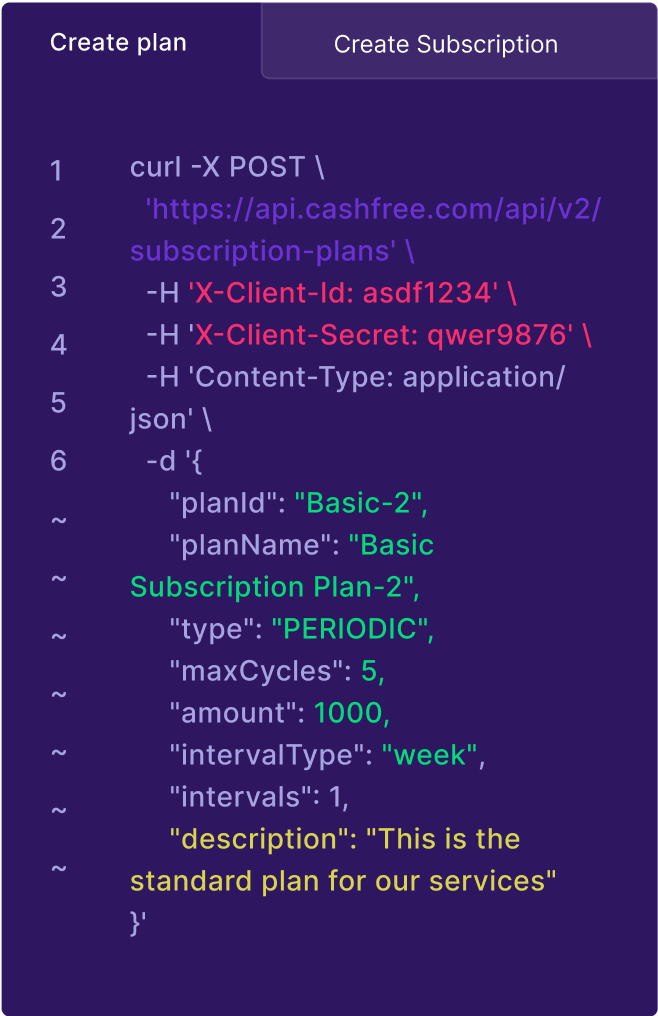

UPI AutoPay

Collect recurring payments

upto ₹15,000 instantly through UPI AutoPay. On-board your customer or borrowers within 30 seconds. Reduce loss of revenue with 30% higher success rates on mandate creation.UPI intent flow supported on:

e-NACH

Enable same-day mandate creation for upto ₹10 Lakhs via e-NACH or e-Mandate. Guarantee faster, superior checkout experience to your customers on netbanking or debit card based authentication.

50+ banks supported

Cards

Debit card

Expand your subscription business to 90+ crore debit card users in India by allowing recurring payment set up via debit card.

Credit card

Easily enable repeat purchases and subscriptions by accepting recurring payments on credit cards and deliver uninterrupted service.

Physical NACH

Provide the convenience of auto-debit to customers who do not have access to digital banking. Set up easy loan recollection with just a one-time signature approval from your borrowers via Physical NACH.

Contact Sales