Verify bank account details for free

You can verify your beneficiary bank account details at no charge using the free credits. With this limited-time offer, experience and test the feature without paying any verification charges.- From the Secure ID dashboard, click Secure ID - Bank Account.

- A banner displays the offer for you on the Secure ID - Bank Account page.

- Click Claim Free Credits and instantly redeem the credits to your account.

Verify domestic bank accounts

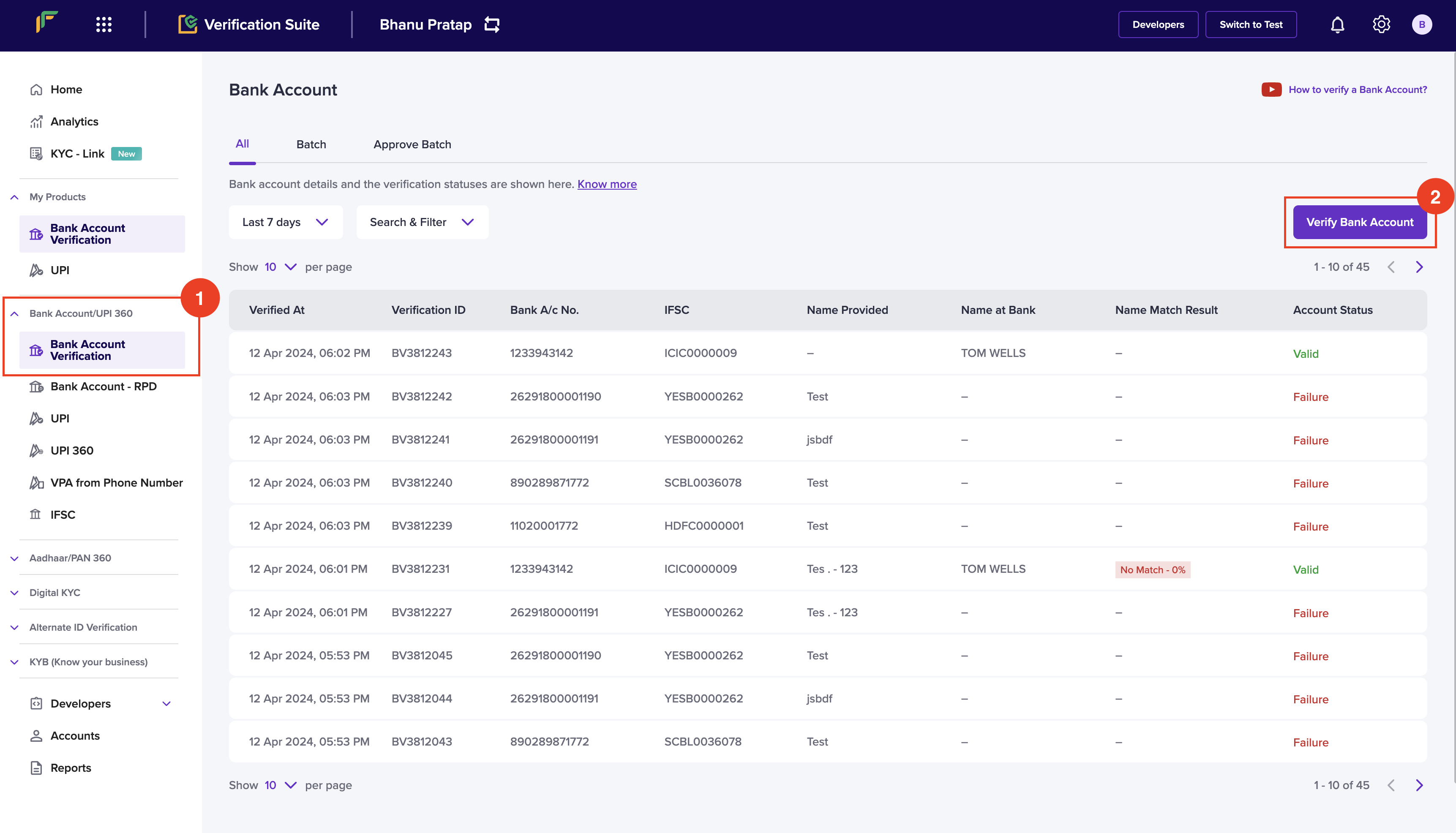

Follow the instructions below to verify domestic bank accounts:- Log in to the Secure ID dashboard using your credentials.

- From the Home screen, navigate to Bank Account/UPI 360 > Bank Account Verification > Verify Bank Account.

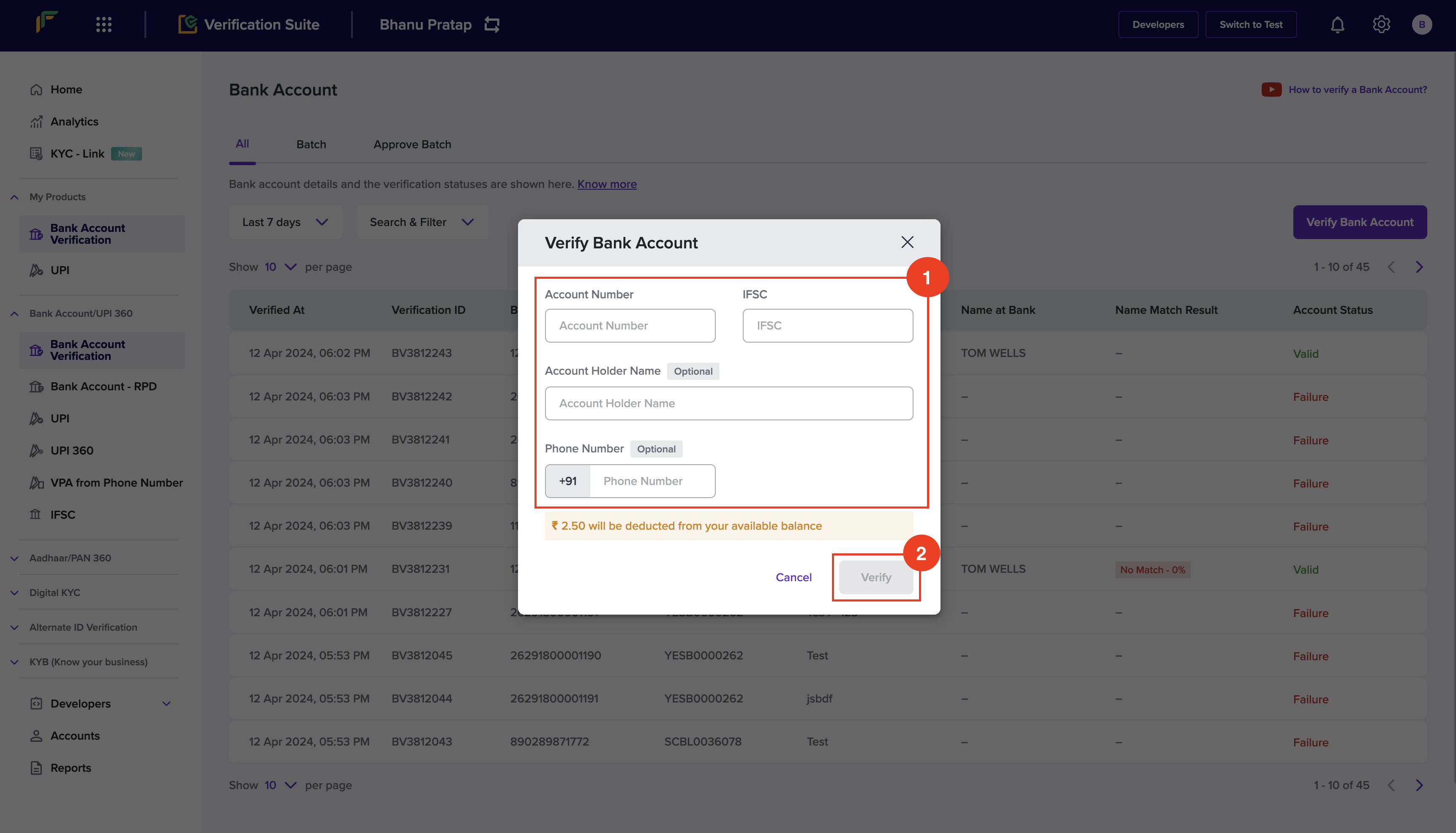

- In the Verify Bank Account popup, enter the following information:

- Account Number: Enter the account number of the individual.

- IFSC: Enter the IFSC information.

- Account Holder Name: Enter the name of the bank account holder.

- Phone Number: Enter the phone number of the individual.

- Click Verify.

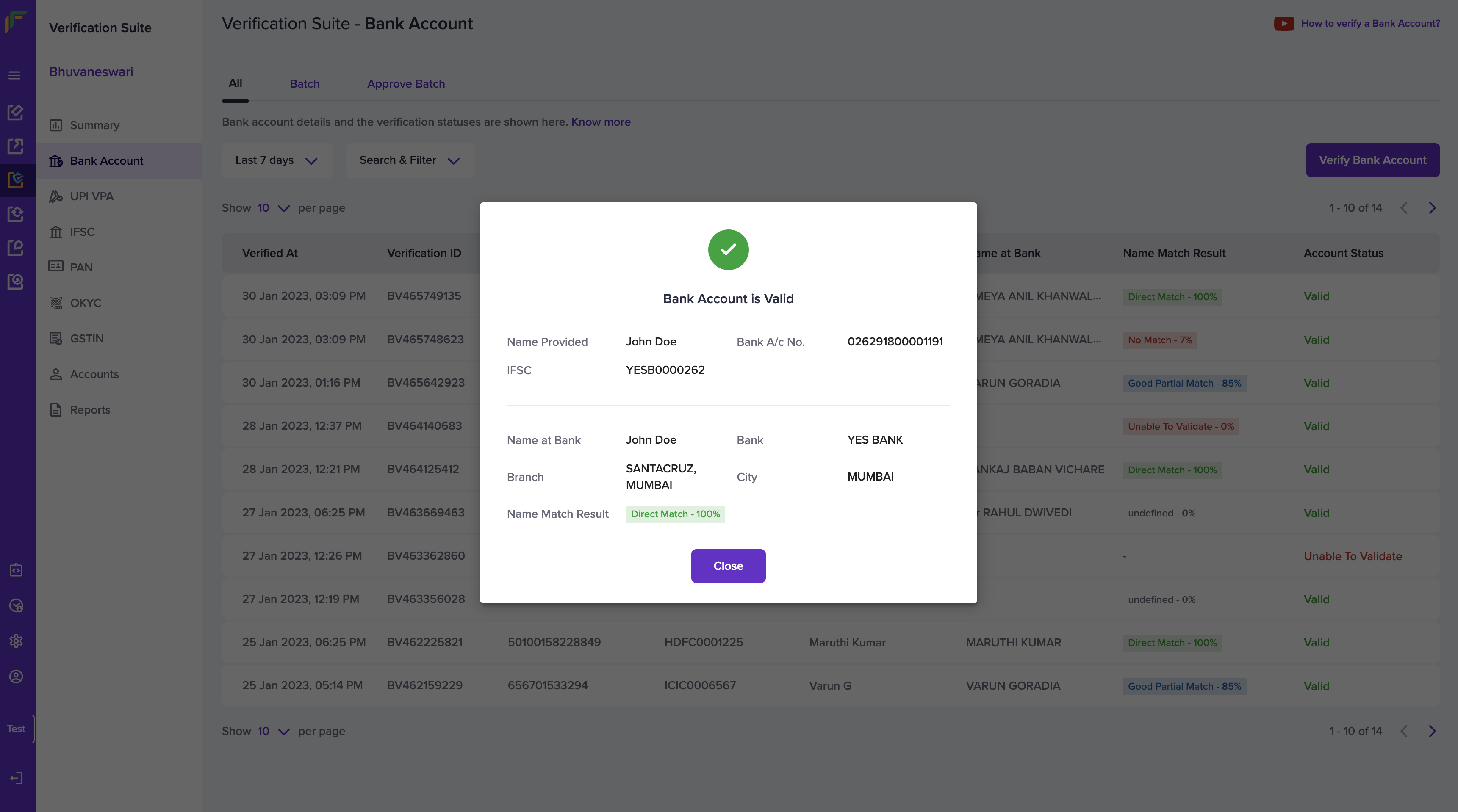

- The bank account information is verified. You will receive a popup that displays if the information is valid or not.

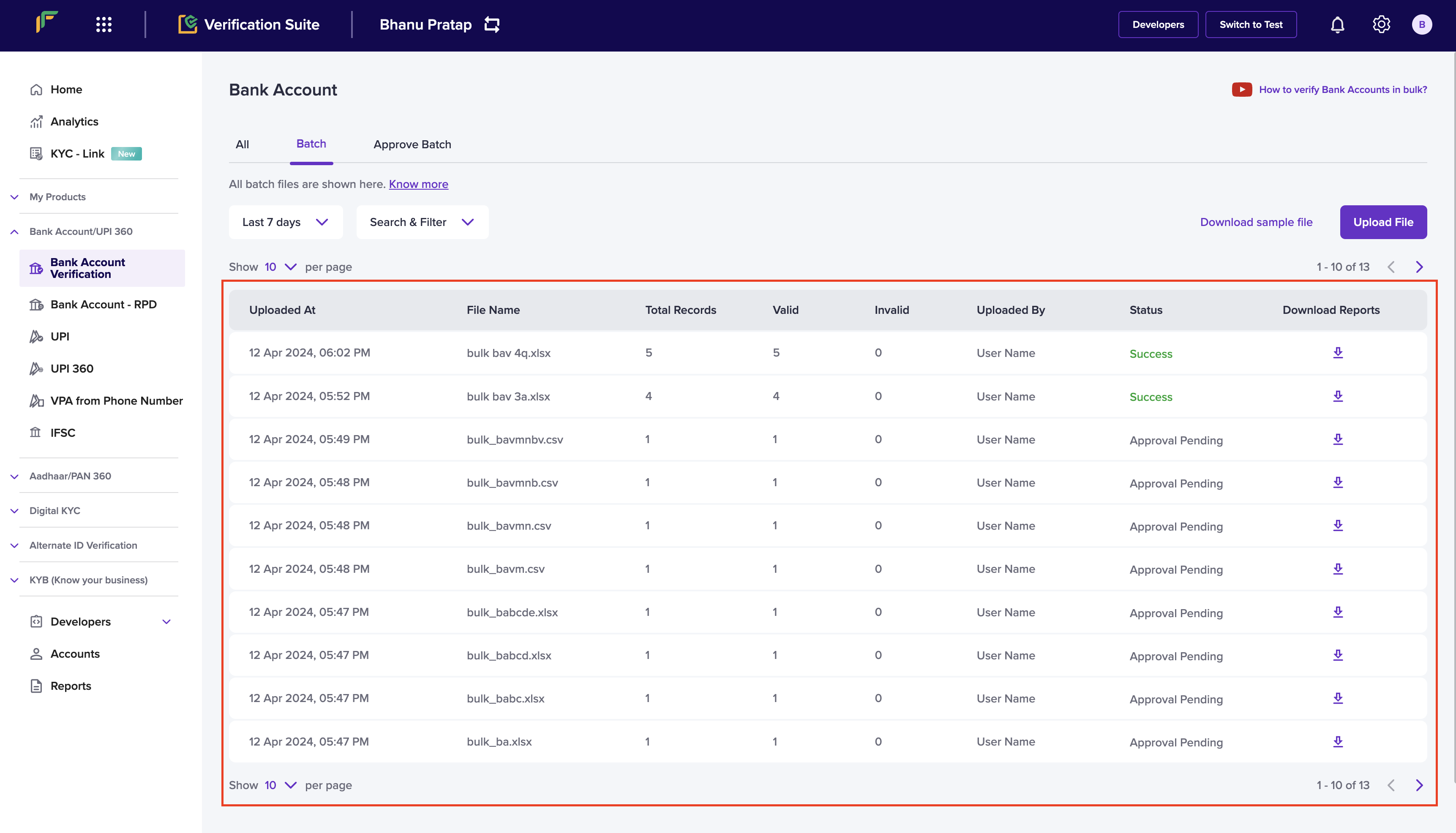

Verify bank accounts in batch

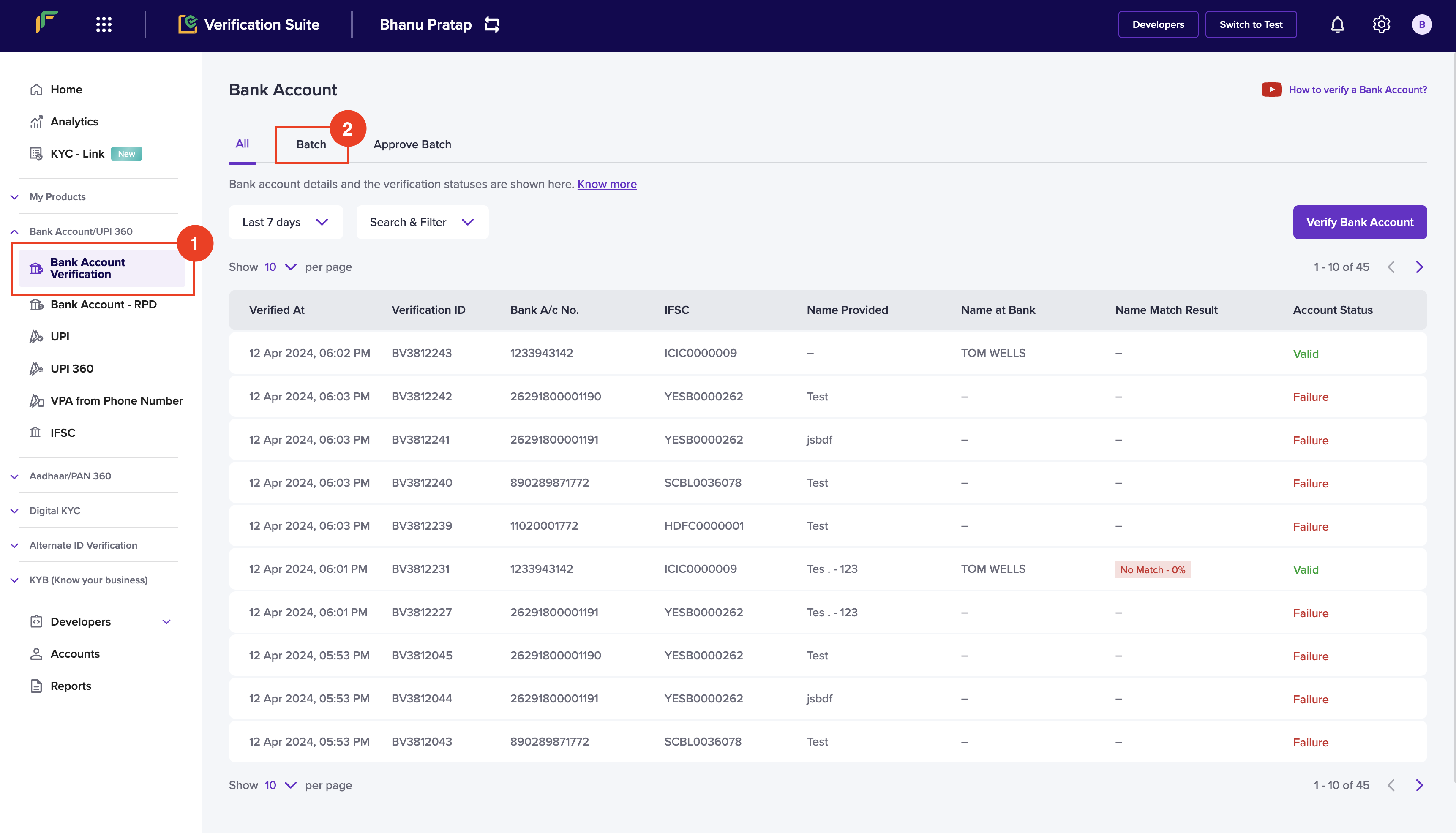

When you have a large number of bank accounts to be verified, you can upload a single file with all the details to verify the accounts in one go, or use the bulk bank account verification API. To verify all the bank accounts, you must upload a .csv, .xls, or a .xlsx file that contains the account number, IFSC, account holder name and phone number of the accounts you want to verify. Download the sample file to know how the details must be filled in the file. Follow the instructions below to upload a batch file:- Log in to the Secure ID dashboard using your credentials.

- From the Home screen, navigate to Bank Account/UPI 360 > Bank Account Verification.

- Click the Batch tab from the Bank Account screen, and click Upload File.

- In the Upload Batch File, click Download sample file to get the format, and enter the bank account information as per the template in the file.

- Click Choose a file to upload the file with the details.

- Click Upload.

- You can view the uploaded file in the form a table in the Batch tab.

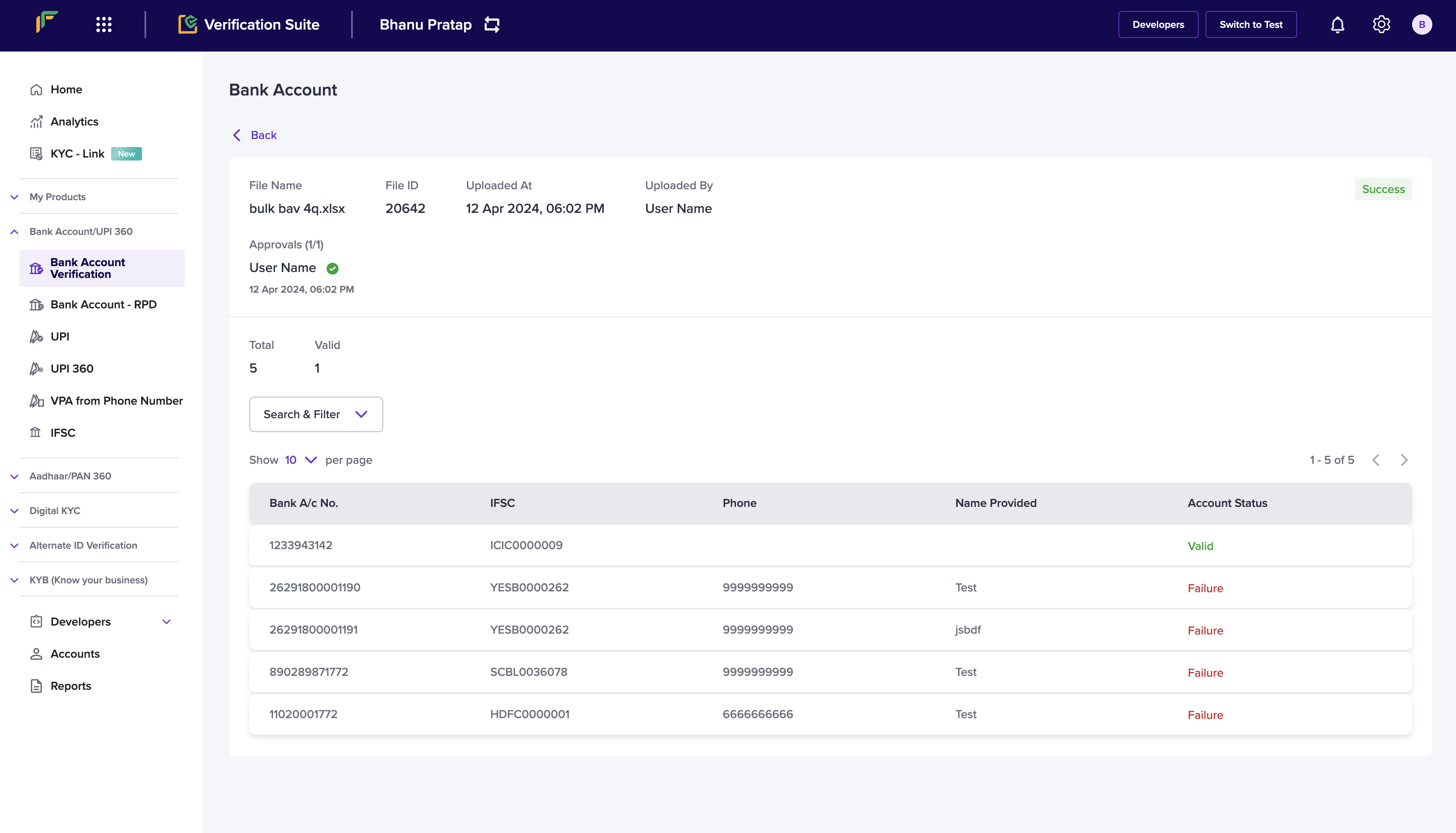

- Click the uploaded file to view the following details:

- File Name: It displays the name of the uploaded file.

- File ID: It displays the unique identifier of the uploaded file.

- Uploaded At: It displays when the file was uploaded.

- Uploaded By: It displays who uploaded the file.

- Approvals: It displays the approver of the file uploaded.

- Total: It displays the number of bank account information added in the file.

- Valid: It displays the number of valid bank account information.

- You can view the following details in the table:

- Bank A/c No.: It displays the bank account number.

- IFSC: It displays the IFSC information.

- Phone: It displays the phone number of the bank account holder.

- Name Provided: It displays the name of the bank account holder.

- Account Status: It displays the status of the bank account.

Approve batch verification flow

To verify a large number of bank accounts in one go, Batch Upload of bank account details is supported. Since it involves processing all the bank account details added in the file in one go, you may want to check and approve the file before the verification begins. To do this, you have to create an approver profile within Cashfree Account and after it gets approved by an approver, bank account details will be verified, and the status of individual accounts will be displayed in the file. All the files that are pending approval will be shown in the Approve Batch section.Name match score

To manually check if the provided customer name and the name registered at the bank are the same, consumes a lot of time and effort. Cashfree Payments has introduced a new feature that will assist you to verify if the names are the same and provide the result accordingly. Two new parameters, nameMatchResult and nameMatchScore will be available in the response, which will help you make faster validations and process payments successfully. This is a recommended feature to ensure that payments are processed to the correct payee account. Contact your Account Manager or Fill out the Support Form to activate the name match score feature for your account. Examples: Direct Match| Name 1 | Name 2 | nameMatchResult | nameMatchScore |

|---|---|---|---|

| Rohan Mathew Thomas | Rohan Mathew Thomas | Direct match | 100.00 |

Good Partial Match

| Name 1 | Name 2 | nameMatchResult | nameMatchScore |

|---|---|---|---|

| Rohan Mathew Thomas | Rohan Thomas | Good partial match | 85.00 |

Moderate Partial Match

| Name 1 | Name 2 | nameMatchResult | nameMatchScore |

|---|---|---|---|

| Rohan Mathew Thomas | Roshan Thomas | Moderate partial match | 61.00 |

Poor Partial Match

| Name 1 | Name 2 | nameMatchResult | nameMatchScore |

|---|---|---|---|

| Rohan Mathew Thomas | Rohan Mathew K | Poor partial match | 55.00 |

No Match

| Name 1 | Name 2 | nameMatchResult | nameMatchScore |

|---|---|---|---|

| Rohan Mathew Thomas | Rajeev | No match | 14.00 |

Score Categorization

| Match Result | Match Score Range |

|---|---|

| Direct Match | 100.00 |

| Good Partial Match | 85.00 - 99.00 |

| Moderate Partial Match | 60.00 - 84.00 |

| Poor Partial Match | 34.00 - 59.00 |

| No Match | 0 - 33.00 |

FAQs

I want to use Cashfree Payments marketplace settlement for paying vendors. Do I need to take verification feature separately?

I want to use Cashfree Payments marketplace settlement for paying vendors. Do I need to take verification feature separately?

How can I use Bank Account Verification API for KYC?

How can I use Bank Account Verification API for KYC?

For how many banks, can I do the verification?

For how many banks, can I do the verification?

How to verify a/c number on Cashfree Payments for multiple individuals?

How to verify a/c number on Cashfree Payments for multiple individuals?

- Manual entry on Cashfree Payments Bank Account Verification dashboard: Here you will be required to enter only two details: Indian bank account number and IFSC. If you want to do bulk verification, You can access the bulk upload feature on the dashboard where you can submit a CSV/XSLX file with required details and get a quick response.

-

Using Bank Account Verification API:

This is an integrated automated way to do single/bulk verification. The API can be integrated with the existing company internal system or ERP and then the request can be pushed directly using APIs.

Why is Bank Account Verification important?

Why is Bank Account Verification important?

I am planning to opt for Cashfree Payouts for bulk disbursals. Do I need to go for verification API separately?

I am planning to opt for Cashfree Payouts for bulk disbursals. Do I need to go for verification API separately?

What are the other use cases of this(BAV) feature?

What are the other use cases of this(BAV) feature?

- A crucial part of the verification process before providing loans of all kinds (education, health, business, car etc)

- Employee background check: A recruitment agency can use the feature for a candidate’s background check

- Vendor onboarding: A marketplace splitting commission with different vendors can use the feature to verify the a/c details at the time of onboarding the vendor, this also helps in correct payments later on.

Is there any limit on the total number of Bank Account Verification requests per day?

Is there any limit on the total number of Bank Account Verification requests per day?

How much time does verification take?

How much time does verification take?

Is there any limit on the total number of UPI requests per day?

Is there any limit on the total number of UPI requests per day?

I am planning to opt for Cashfree Payouts for bulk disbursals on UPI ID. Do I need to go for Verification API separately?

I am planning to opt for Cashfree Payouts for bulk disbursals on UPI ID. Do I need to go for Verification API separately?

How to verify UPI ID on Cashfree Payments for multiple individuals?

How to verify UPI ID on Cashfree Payments for multiple individuals?

- Manual entry on Cashfree Payments UPI ID verification dashboard. Here you will be required to enter only one detail: UPI ID (eg abc@okaxis)

-

Using API

An integrated automated way to do UPI Verification. The API can be integrated with the company’s existing internal system or ERP and the request can be pushed directly using APIs.

What is UPI ID Verification?

What is UPI ID Verification?

- Background verification at the time of onboarding a new user/vendor

- Before releasing payment to a UPI ID

How much time does the Verification take?

How much time does the Verification take?