Cashfree turns 10! Celebrate with 1.6%* gateway fee for new merchants – limited period!

Settlement and Reconciliation Guide

What is Payment Gateway settlement?

A settlement in payment gateway refers to the process by which the payment made by a customer for a product/service, is credited to the merchant account.

What are the different types of settlements offered by Cashfree?

Standard Settlements

The standard settlement cycle in Cashfree is T+2* days, where T is the date of the transaction. For instance, if the transaction takes place on a Monday, the settlement will be credited to the merchant's account on Wednesday. The standard settlements happen only on bank working days.

Instant Settlements

The Instant Settlement cycle in Cashfree lets merchants get access to their funds in 15 mins! Merchants can make use of the settled funds for disbursals to vendors and other partners. These settlements are processed even on bank holidays!

Customer enters the payment details in Cashfree’s checkout forms

The transaction is authenticated by the customer using OTP verification

The amount is received at Cashfree’s acquiring banks

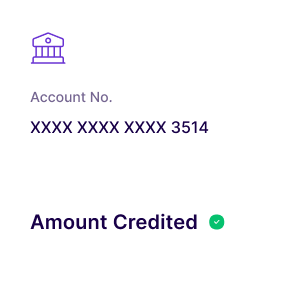

Amount is credited in merchant’s account in T+2* days after payment gateway deductions.

Cashfree makes it easier for merchants to track all their settlements in a single place. The Summary gives a quick overview of the total recent settlements that have been processed, and the settlements tab lets the merchants keep track of the default and instant settlements.

Apply Filters: Customize your report for a specific time period and track the status of the settlements within the time period

Search by order ID:Find the settlement status for a particular order by entering the appropriate order ID

Track Status:Each entry will also hold the corresponding status of the settlements

How do you reconcile your settlements with the transactions?

The reports module in PG dashboard lets you download the settlements report on a daily or monthly basis, and reconcile them. Each settlement will contain the list of transactions that were included in the settlement cycle. Each entry will bear the following information with respect to the settlement:

Unique Transaction Reference number

This unique ID is used to identify each settlement.

Individual transaction date and time

List of transactions with their corresponding date and time.

Net settlement amount

The actual amount from the transaction that has been settled to the merchant’s bank account.

TDR charges

The payment gateway processing fee for the particular transaction.

Transaction amount

The amount for each transaction inside the settlement cycle.

Settlement date

The date on which these settlements have been made.

Adjustments in Settlement Report

The second part of the settlement report has the details of adjustments that were made in the particular settlement cycle. These adjustments also bear the EVENT of the adjustment, i.e, the type of adjustment that has happened in the settlement cycle.

FUND_SWEEP: A DEBIT entry which implies that the corresponding amount has been settled in the merchant’s settlement account.

SETTLEMENT_COMPUTE: A CREDIT entry which is a summation of all transactions that are considered for settlement in the given settlement cycle.

REFUND: A DEBIT entry that corresponds to the refund initiated by the merchant.

DISPUTE: A DEBIT entry for a dispute raised against a transaction.

RISK: A DEBIT entry for a transaction identified as a risk transaction.

Get faster access to your funds and automate reconciliation

Get in Touch* Settlement cycle is subject to bank approval and can vary based on transaction type, business category/model, risk parameters and other factors.

Ready to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access