Foreign Inward Remittance Certificate (FIRC): Everything That You Need To Know

Collect International Payments in 4 simple steps

Step 1

Quick and easy sign-up

Complete your KYC and get started

Step 2

Local collection accounts

Get your account details for international currencies

Step 3

Simplified collection process

Share account details and receive funds hassle-free

Step 4

Seamless tracking and compliance

Monitor transactions and receive e-FIRA promptly

Inward Remittance

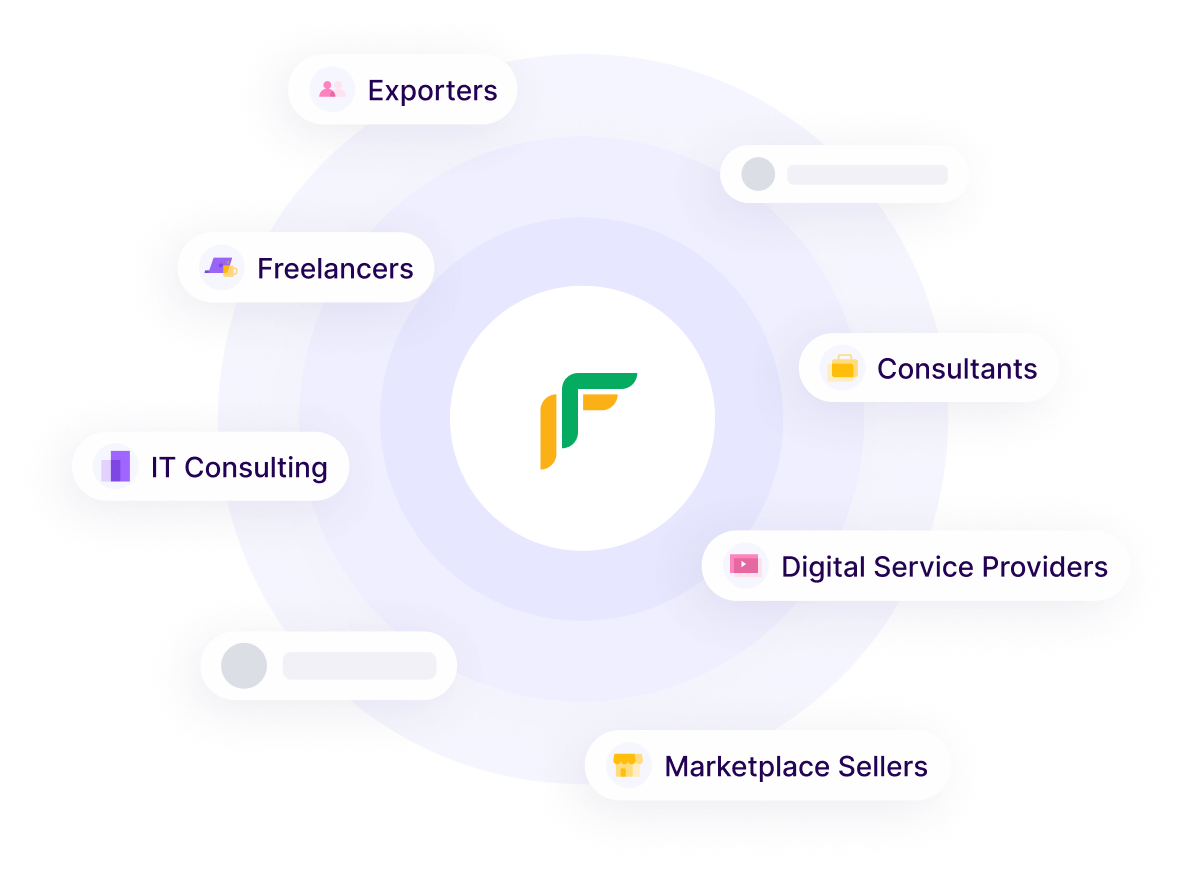

for your businessPerfect for all businesses

international wire transfers

, Cashfree Payments has got you covered. With us, you can effortlesslycollect international payments in India

from clients worldwide.

YOU'RE IN GOOD COMPANY

Have more questions?

Visit our support pageForeign Inward remittance refers to the transfer of money to Indian from anywhere outside India. For example, when you receive money in your Indian bank account from a business or an individual abroad, it is called foreign inward remittance.

Foreign Inward Remittance Certificate (FIRC) is a document proof for any foreign transfer to India, in case of export of goods. For export of services, there will be no tax levied if there is an FIRC available with the business. FIRC is also important to avail export related schemes such as EPCG (Export promotion capital goods) and others.

Global Collections is a technology payments platform that is built for exporters who want to receive international payments. This solution is recommended for exporters who are dealing in goods or services having invoice value of up to USD 10,000.

Traditionally exporters in India have been receiving payments via SWIFT. With Global Collections solutions, the exporters can get 5 dedicated local accounts - in 4 currencies namely USD, GBP, EUR and CAD and a Global SWIFT Account to accept payments in 30+ currencies.

Payers/importers can make cross border payments as easy as domestic payments by using local rails like ACH, SEPA, EFT and Faster payments and the amount is credited to the respective local collection account.

Exporters can receive these payments in importer's or payer's home currency without the exporter having to open a bank account in foreign countries saving his/her time, effort and money.

You can visit www.cashfree.com/international-payments/international-wire-transfer/ and click on Contact Sales. Please fill in the basic details about your company and Cashfree Payments sales representatives will reach out to you with 24 working hours to help you get started.

Just like there is NEFT in India, there is ACH in the US, SEPA in Europe region, EFT in Canada and Faster payments in UK.

Using the Global Collections solution, exporters get a dedicated collection account each in USD, GBP, EUR and CAD and a SWIFT account to receive payments in other currencies. This way an exporter can get paid via payer's local rails instead of SWIFT.

Example: A payer residing in the US can initiate an ACH transfer into the receiver's (Indian exporter's) local receiving USD account.

If you are selling goods or services outside of India having invoice value up to USD 10,000, you can use global collection accounts. The payer can be an individual or a business as the case may be, as long as payment is for sale of goods or rendering of service(s).

- High valued goods like Jewellery

- Petroleum, Oils and Lubricants (POL)

- Pharma products including equipment

- Other line of businesses as per discretion of Cashfree Payments.

No, as per the OPGSP guidelines, all international inward remittance payments must be settled in INR to exporter's bank account by the AD-1 partner bank. In case of Global Collections, the payments received in currency accounts will be settled to your local bank account in India.

Yes. Cashfree Payments' AD-1 partner will issue eFIRS on T+1 basis. T being the day on which the beneficiary receives the payment in his/her bank account in India. The eFIRS will be sent via email to your registered email address.

Yes. Here is the OPGSP guideline for your reference.

- The facility shall only be available for export of goods and services (as permitted in the prevalent Foreign Trade Policy) of value not exceeding USD 10,000 (US Dollar ten thousand) per transaction. There is no daily or monthly limit on the number of transactions. However, the value of a single transaction should not exceed USD 10,000

- Where the exporters availing this facility are provided notional accounts (Global Collection Accounts) with the OPGSP, it shall be ensured that no funds are allowed to be retained in such accounts and all receipts should be automatically swept and pooled into the NOSTRO collection account opened by the AD Category-I bank.

- The balances held in the NOSTRO collection account shall be repatriated to the Export Collection account in India and then credited to the respective exporter's account with a bank in India immediately on receipt of the confirmation from the importer and, in no case, later than seven days from the date of credit to the NOSTRO collection account.

Here's the list of purpose codes to be followed for OPGSP transactions.

Have more questions?

Visit our support pageReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access