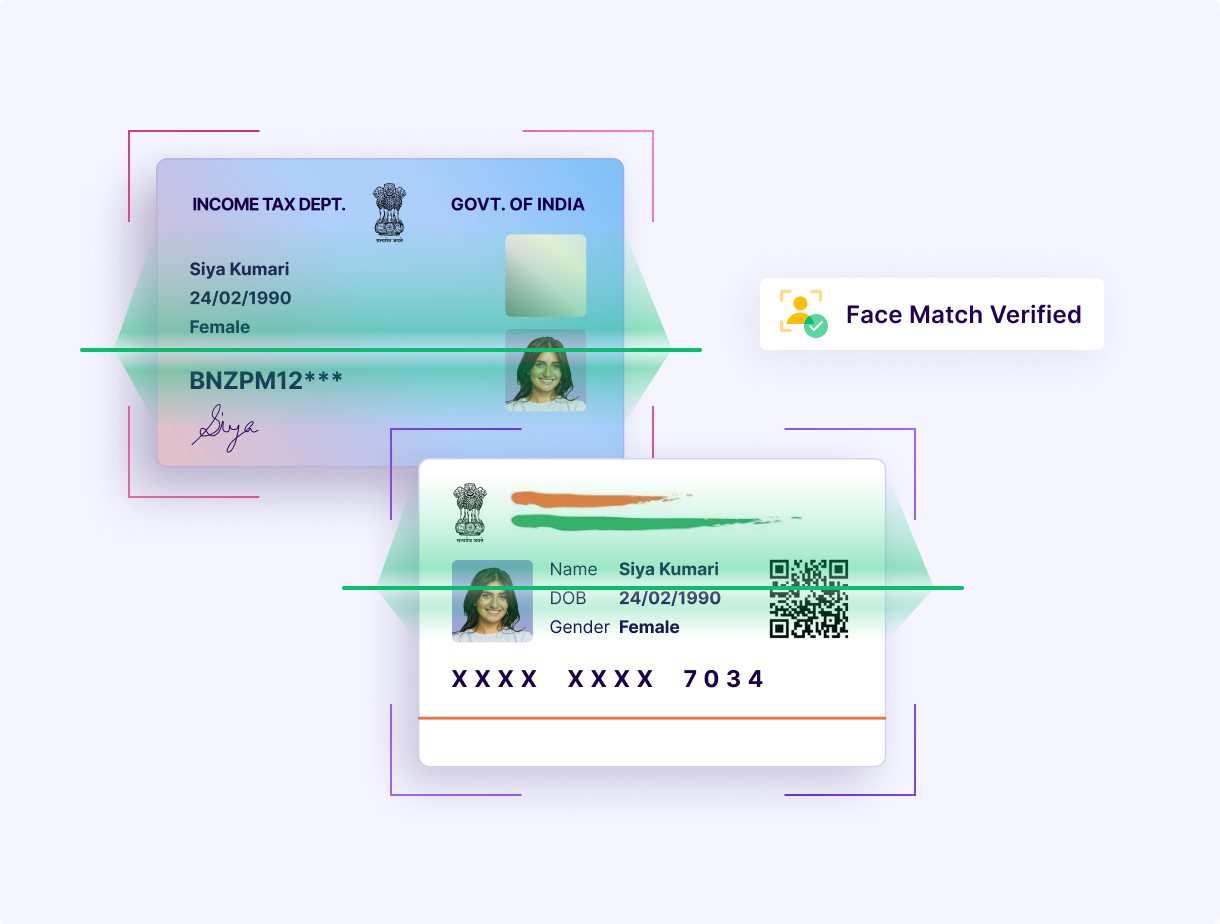

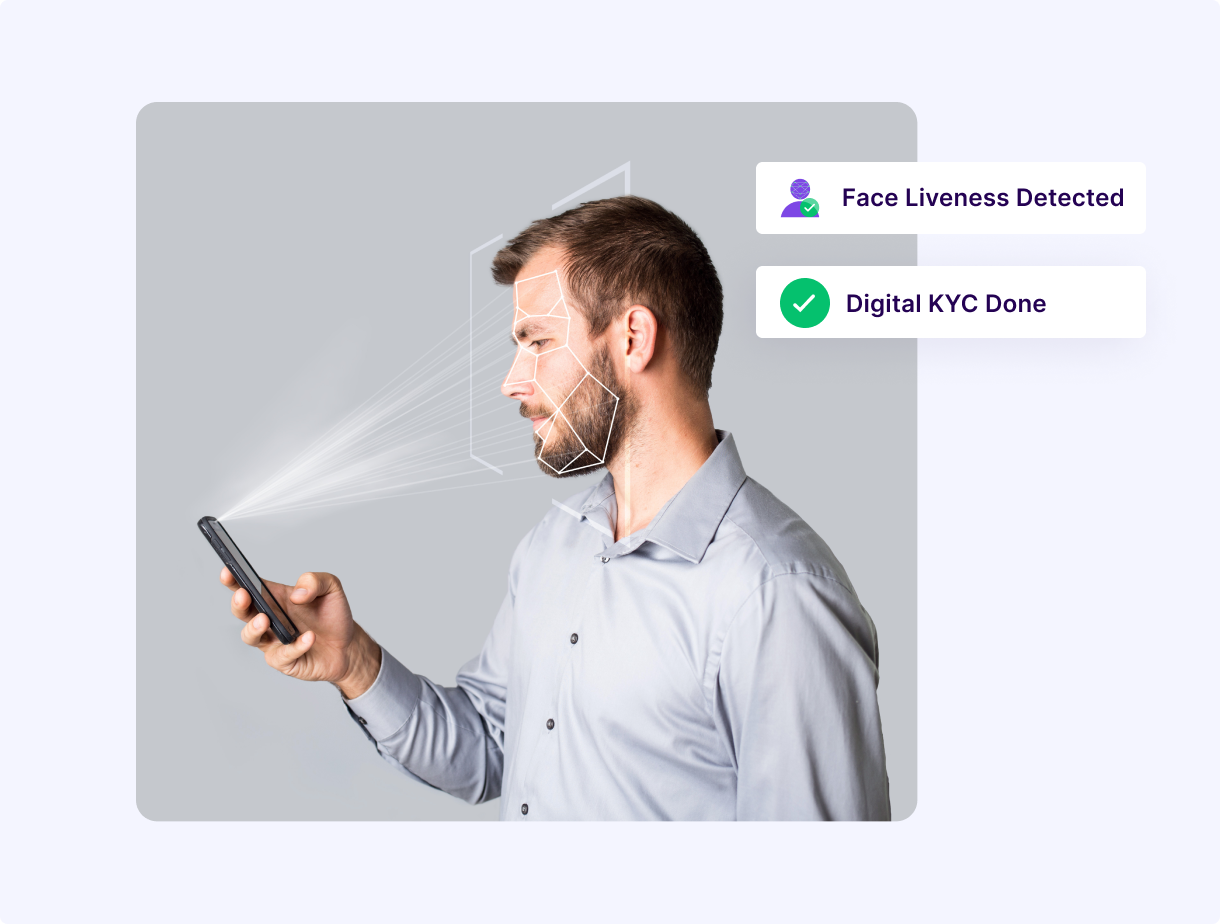

Face Match and Face Liveness Detection

Ensure customer credibility with real-time facial recognition and verification via Face Match API and Face Liveness Detection.

Create Account

Plug And Play API

Real-time and Reliable

Enhanced User Experience

Compliance Check

Fraud Prevention

Step 1

Upload an ID

Upload an ID of your customer that is issued by the Indian government.

Step 2

Upload a Selfie

Upload a real-time photo (selfie) of your customer.

Step 3

Verify

Get instant results based on facial feature analysis and comparison of selfie with the ID photograph.

Compare faces between two images or IDs

Reduce customer drop-offs during onboarding

Pair with Face Liveness Detection API for robust Digital KYC

Verify if the customer is genuine and not a bot

Screen out spoofs, frauds and bots instantly

Streamline Digital KYC with Face Match API

Allow faster account opening, and secure account access for new applicants, as per RBI’s guidelines for Digital KYC.

Verify identities through facial authentication during onboarding and insurance processing.

Streamline Digital KYC verification for quick customer onboarding. Offer convenience for retail investors to sign up and invest. Keep fraudsters away.

Fast-track user onboarding and validate user identity for Digital KYC verification, credit card or prepaid card allotments, quick loans etc.

Have more questions?

Visit our support pageHave more questions?

Visit our support pageSecure ID

Onboard users seamlessly with our compliant and highly customisable 360° identity verification platform

Learn MorePayouts

Easiest way to make payouts to any bank account, UPI ID, card, AmazonPay, Paytm or other native wallet 24*7 instantly even on a bank holiday.

Learn MoreSubscriptions

Accept recurring payments by auto-debiting customer’ accounts via standing instructions on cards or UPI e mandate.

Learn More

Ready to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access