Cashfree turns 10! Celebrate with 1.6%* gateway fee for new merchants – limited period!

eNACH

Streamline high-value recurring payments for your business witheNACH

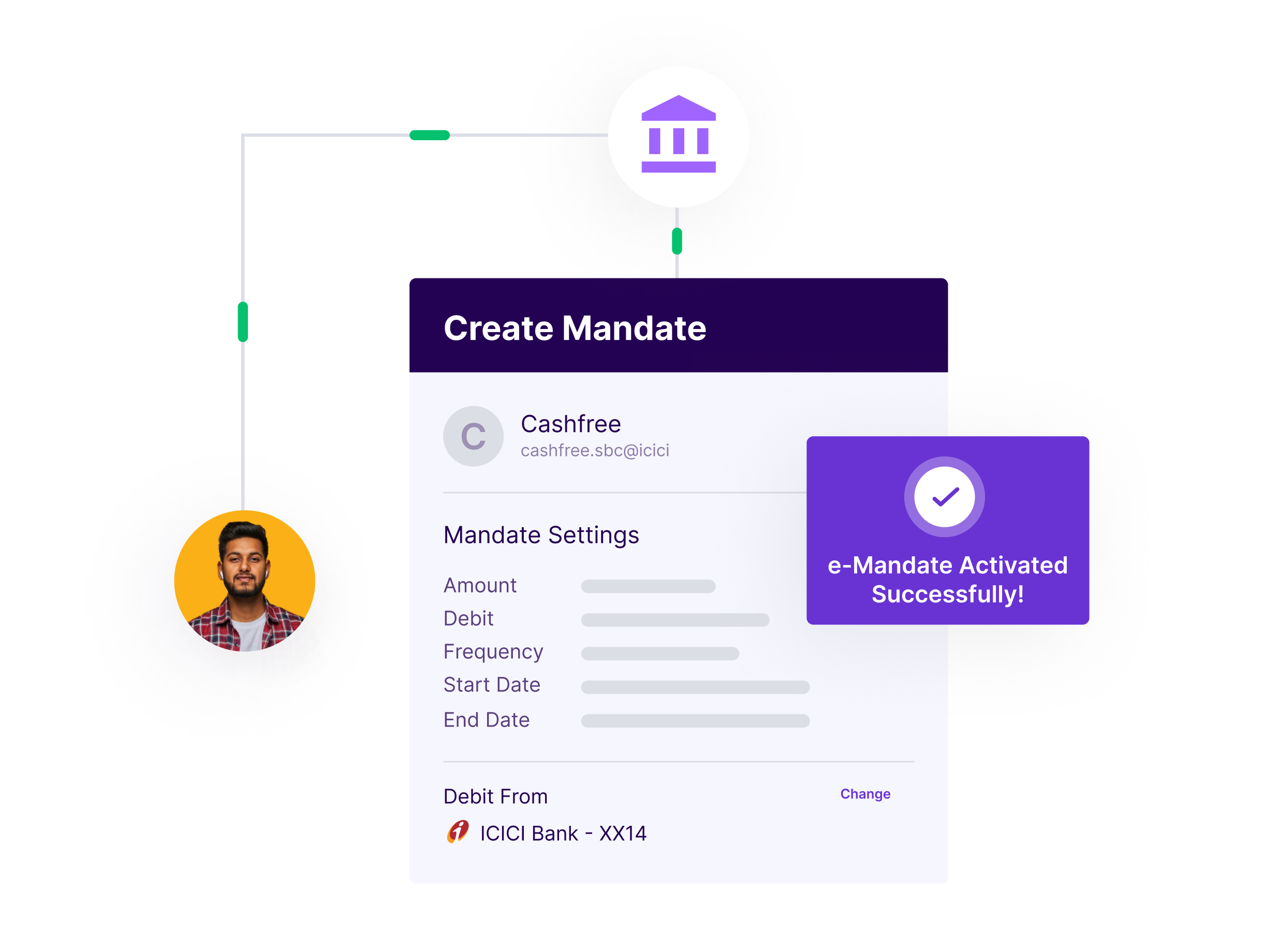

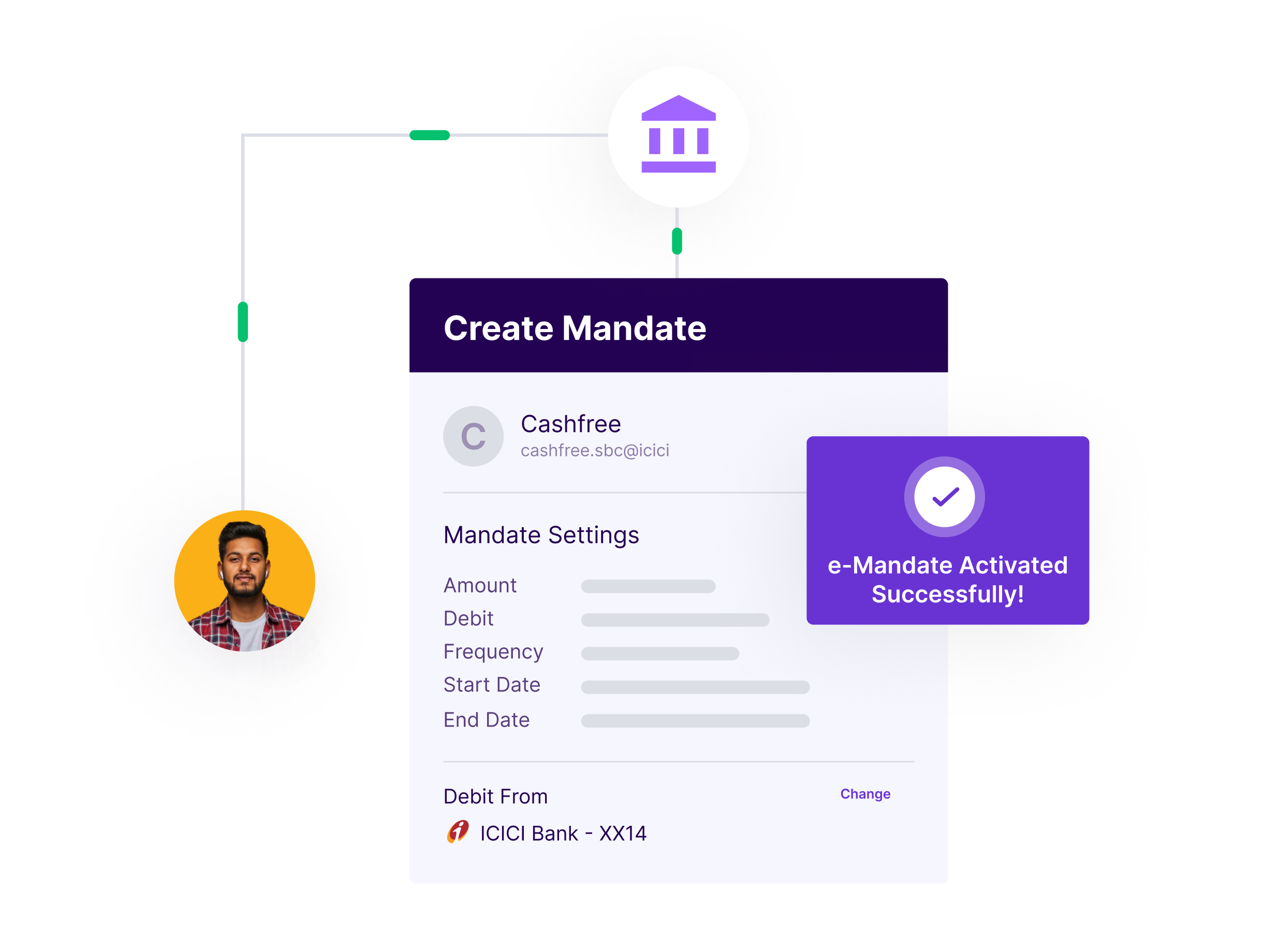

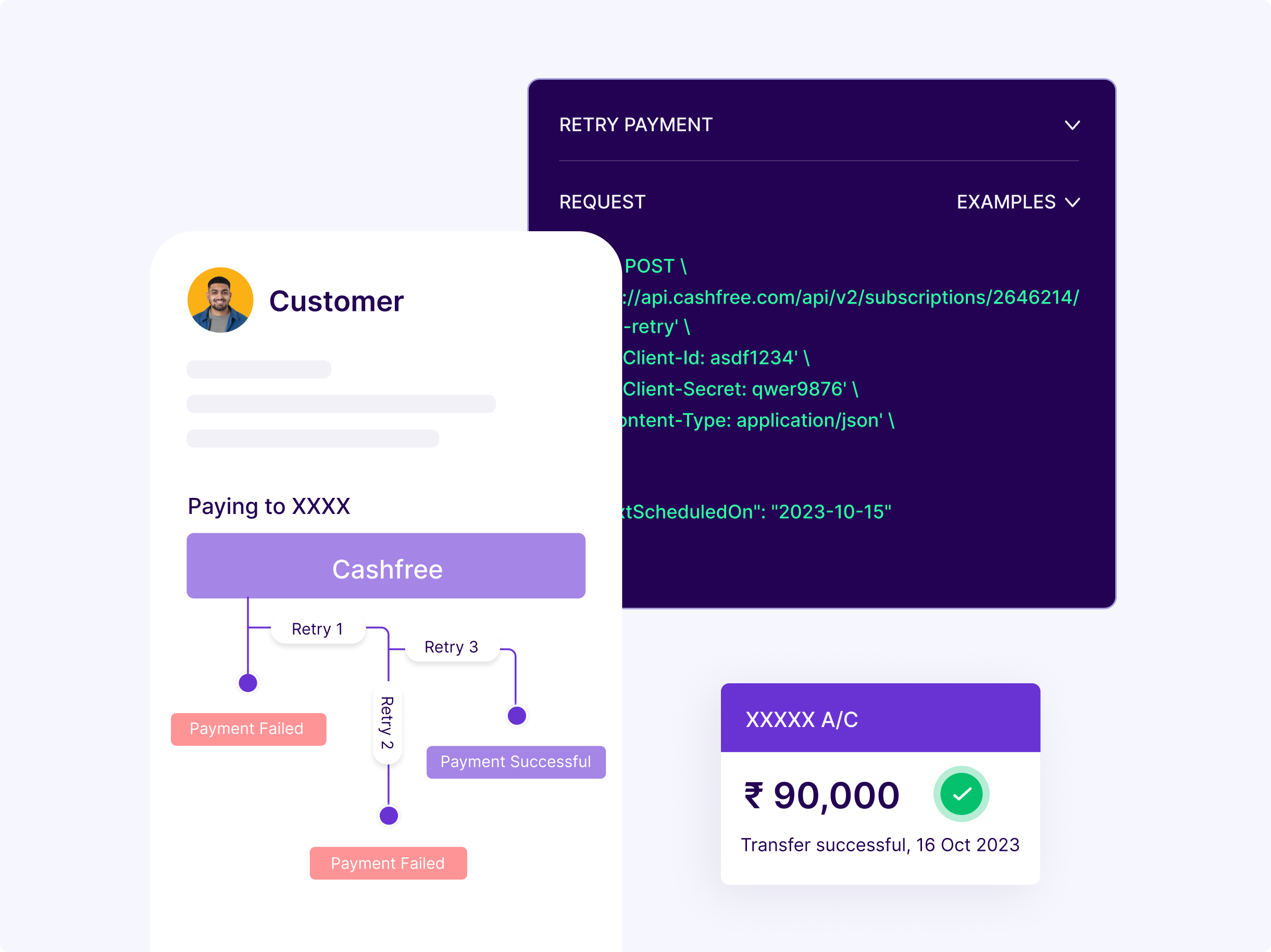

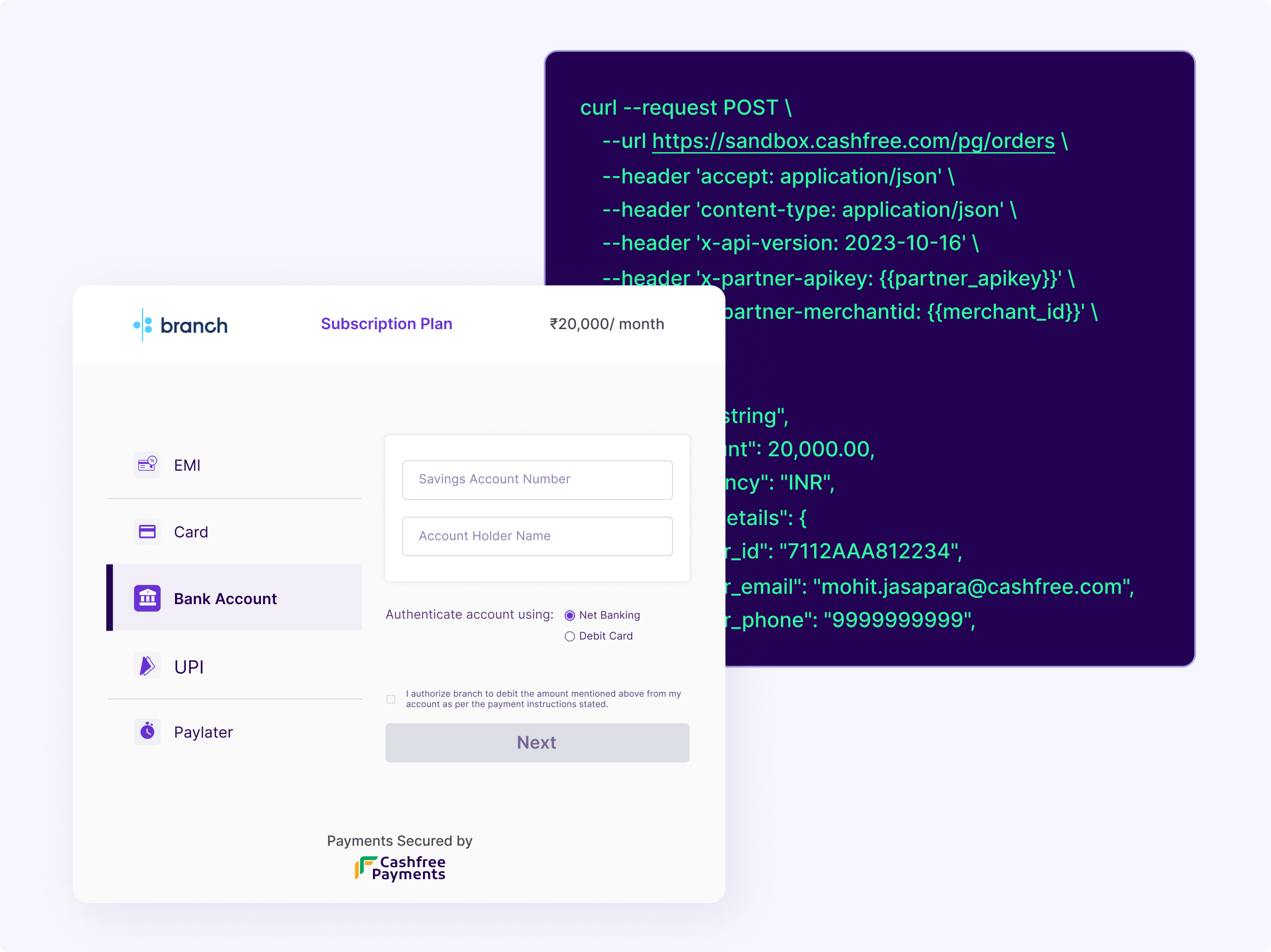

Create fast and secure digital mandates and collect large recurring payments. With Cashfree’seNACH

, authorise auto-debit from customer bank accounts up to ₹ 1Cr across 50+ banks.24-hr mandate creation

Up to ₹ 1Cr transaction limit

50+ bank integrations

Authorise future payments by creating e-Mandates that get activated within 1 to 2 days and automate all future debits.

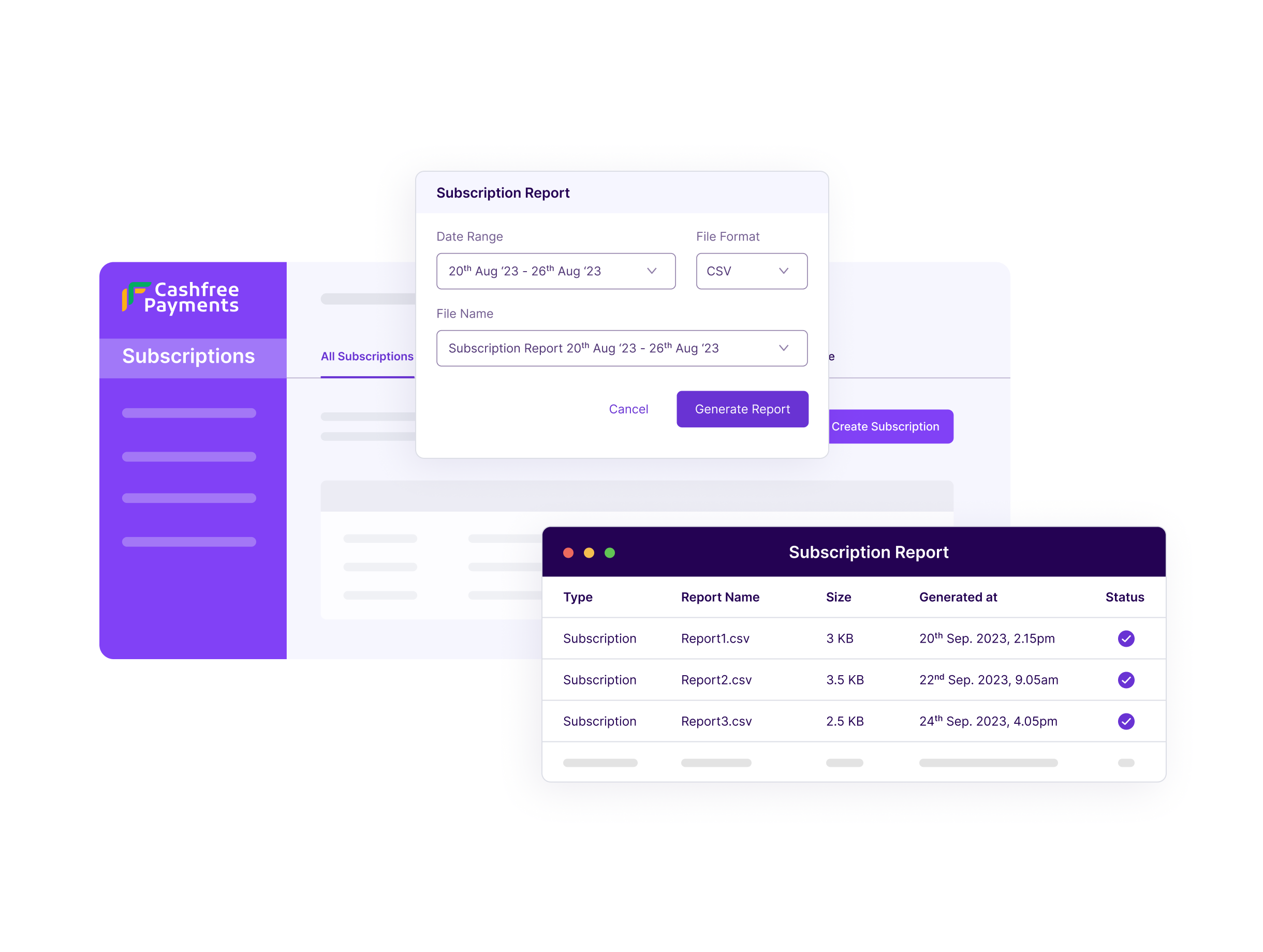

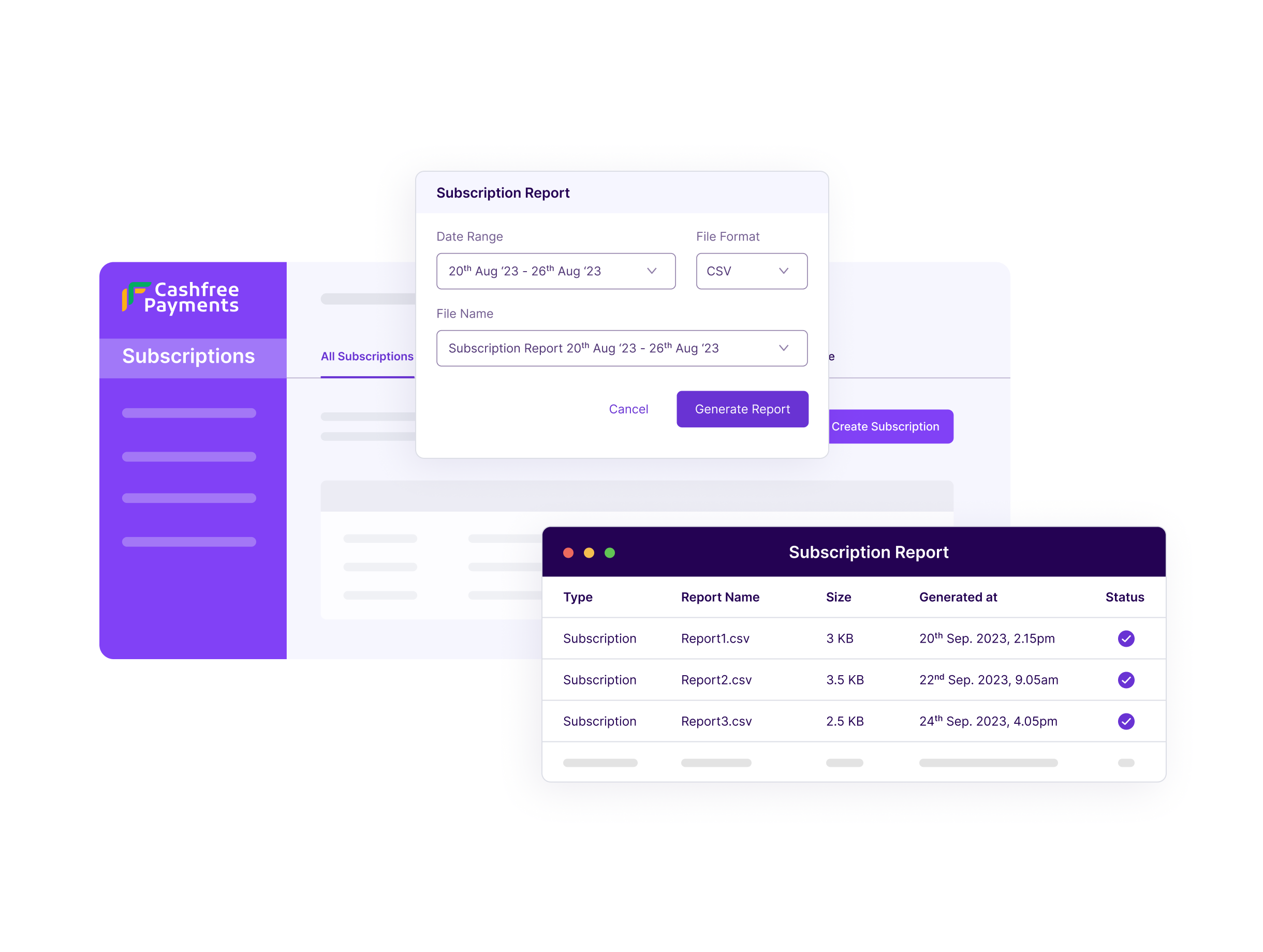

Manage all your subscriptions from Cashfree’s easy-to-use subscription dashboard and get actionable insights from the detailed subscription and payment reports.

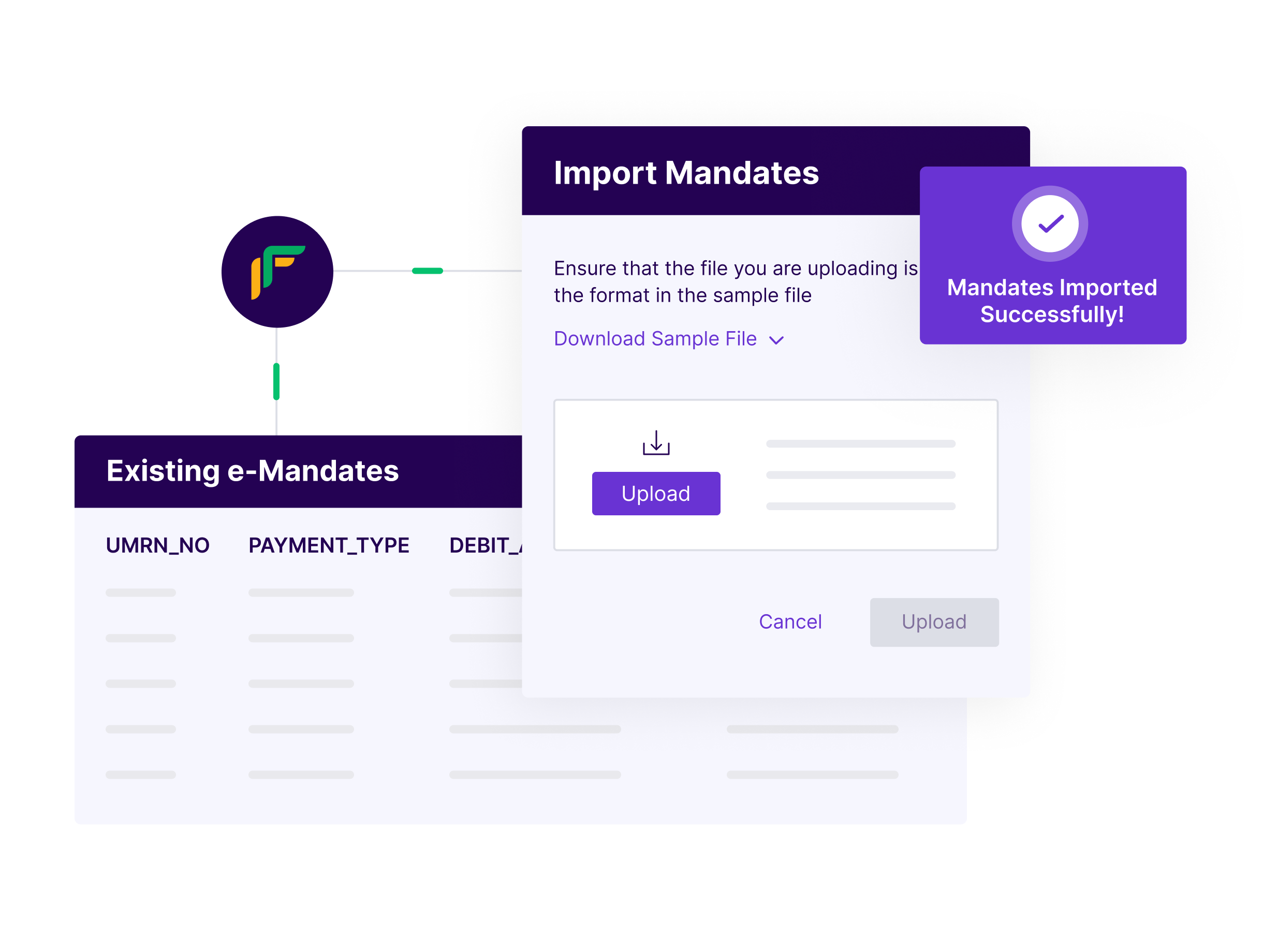

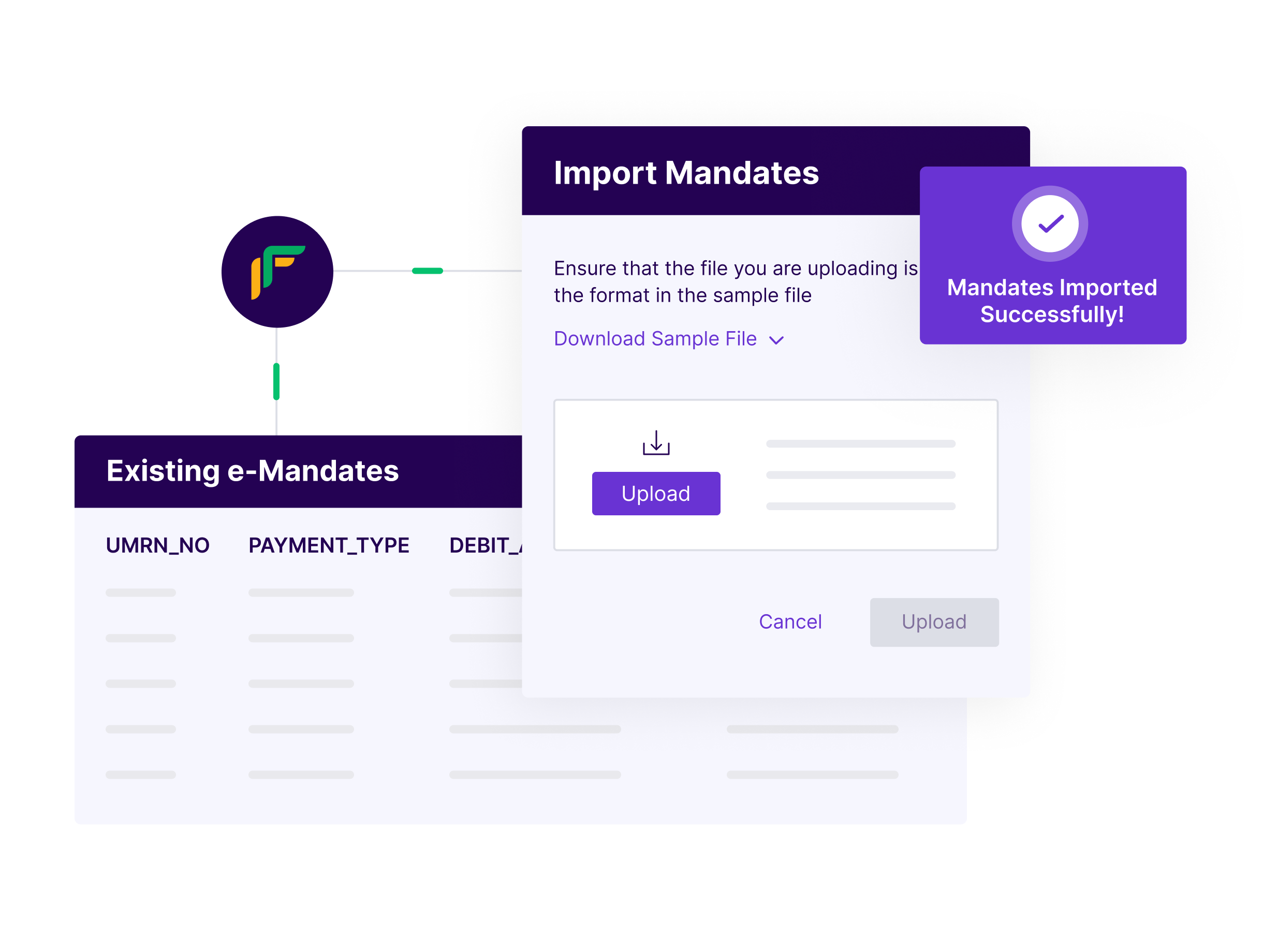

Migrate mandates easily from your existing payment provider to provide a seamless subscription experience to your customers.

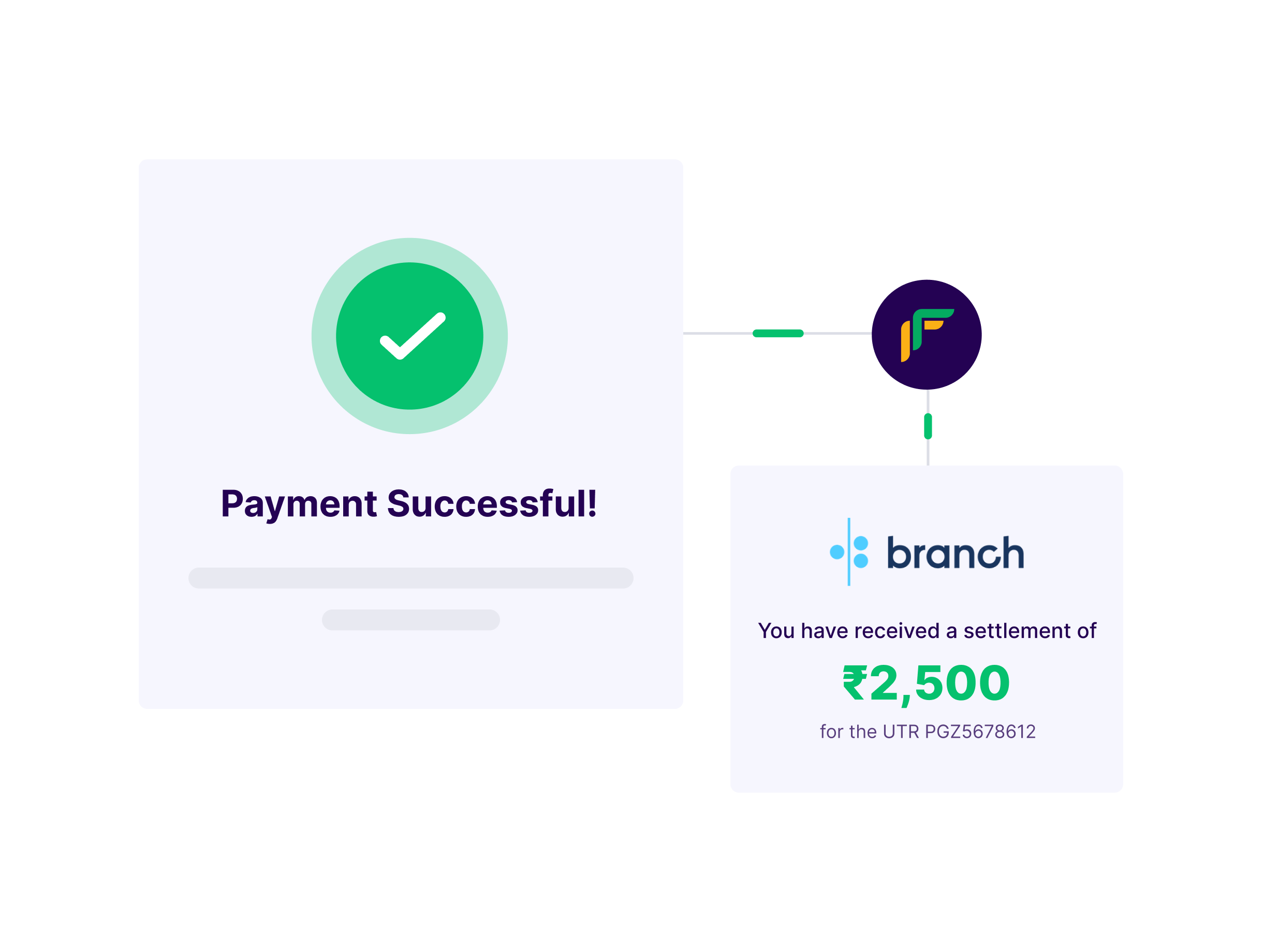

Get settlements as soon as your customer makes the payment. Do away with the usual T+2* day cycle and get access to your funds instantly.

Authorise future payments by creating e-Mandates that get activated within 1 to 2 days and automate all future debits.

Manage all your subscriptions from Cashfree’s easy-to-use subscription dashboard and get actionable insights from the detailed subscription and payment reports.

Migrate mandates easily from your existing payment provider to provide a seamless subscription experience to your customers.

Get settlements as soon as your customer makes the payment. Do away with the usual T+2* day cycle and get access to your funds instantly.

Security ensured, stay RBI compliant

At Cashfree Payments we ensure that all the UPI authentications initiated and auto-debits processed are as per latest government guidelines.

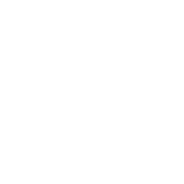

Reduce loan defaults and late repayment by setting up auto-debits via eNACH. Leverage ~*98% success rate (excluding business declines) on subsequent EMIs with payment retries.

Set and authorise e-Mandates on KYC verified bank accounts and curate uninterrupted investment experience for your customers.

Offer custom insurance plans and set up eNACH based e-Mandates for collecting premiums on a monthly, quarterly, half-yearly or yearly frequency.

Increase retention by 3X with one-time authorisation on eNACH. Create subscription plans to provide your learners with flexible learning options and budget-friendly EMIs.

Grow your business by creating custom payment plans for your product/service. Auto-deduct payments via e-Mandate on-demand, based on service usage or debit the amount periodically.

Collect rent for housing and office rentals, co-working and co-living spaces, and other rental facilities with the ease of subscriptions.

Fixed Model

Usage Based Model

e-Mandates

on KYC verified bank accounts and curate uninterrupted investment experience for your customers.Hybrid Model

e-Mandates

for collecting premiums on a monthly, quarterly, half-yearly or yearly frequency.pricing

Grow your subscription business with India’s favourite recurring payments solutionPaperless and same day onboarding

E-commerce Plugins

Easy-to-use dashboard

Developer friendly integration kits

Industry-best support

Fast settlements

For questions around implementation, customised pricing and more, reach out to us here .

AutoPay

UPI AutoPay

Automate recurring payments up to ₹ 15000 by using the most popular payment method in India - UPI. Customers can activate the one-time UPI mandate from any of 20+ supported UPI apps.

Physical Mandate

Auto-debit is possible to configure for customers who do not have access to net banking or a debit card through one-time physical signature approval.

SI on cards

Customers can enter credit or debit card details, give standing instruction (SI) for future automated payments. Businesses can collect recurring payments of up to ₹15,000/- without 2FA / OTPs.

Have more questions?

- Raise a ticket on your dashboard

- Email at care@cashfree.com

- Get in touch with your Account Manager at Cashfree.

Have more questions?

Visit our support pageUPI AutoPay

Collect recurring payments upto ₹15,000 instantly through mandates created via any UPI app. Reduce loss of revenue with 30% higher success rates on mandate creation.

Learn MoreEasy Split

Verify and onboard vendors, collect payments from customers, deduct commissions, and split payments between vendors or your own bank accounts.

Learn MorePayment Gateway

Collect payments on your website or app. Verify account details before doing customer refund.

Learn MorePayouts

Make payouts to any bank account / UPI ID / card/ AmazonPay / Paytm instantly even on a bank holiday.

Learn More* Settlement cycle is subject to bank approval and can vary based on transaction type, business category/model, risk parameters and other factors.

Ready to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access