Cashfree turns 10! Celebrate with 1.6%* gateway fee for new merchants – limited period!

Digital Onboarding

- > 99% success rate

- 100% uptime

100M+

Monthly verifications

50%

Reduction in onboarding drop-offs

1 sec

Response time for > 90% requests

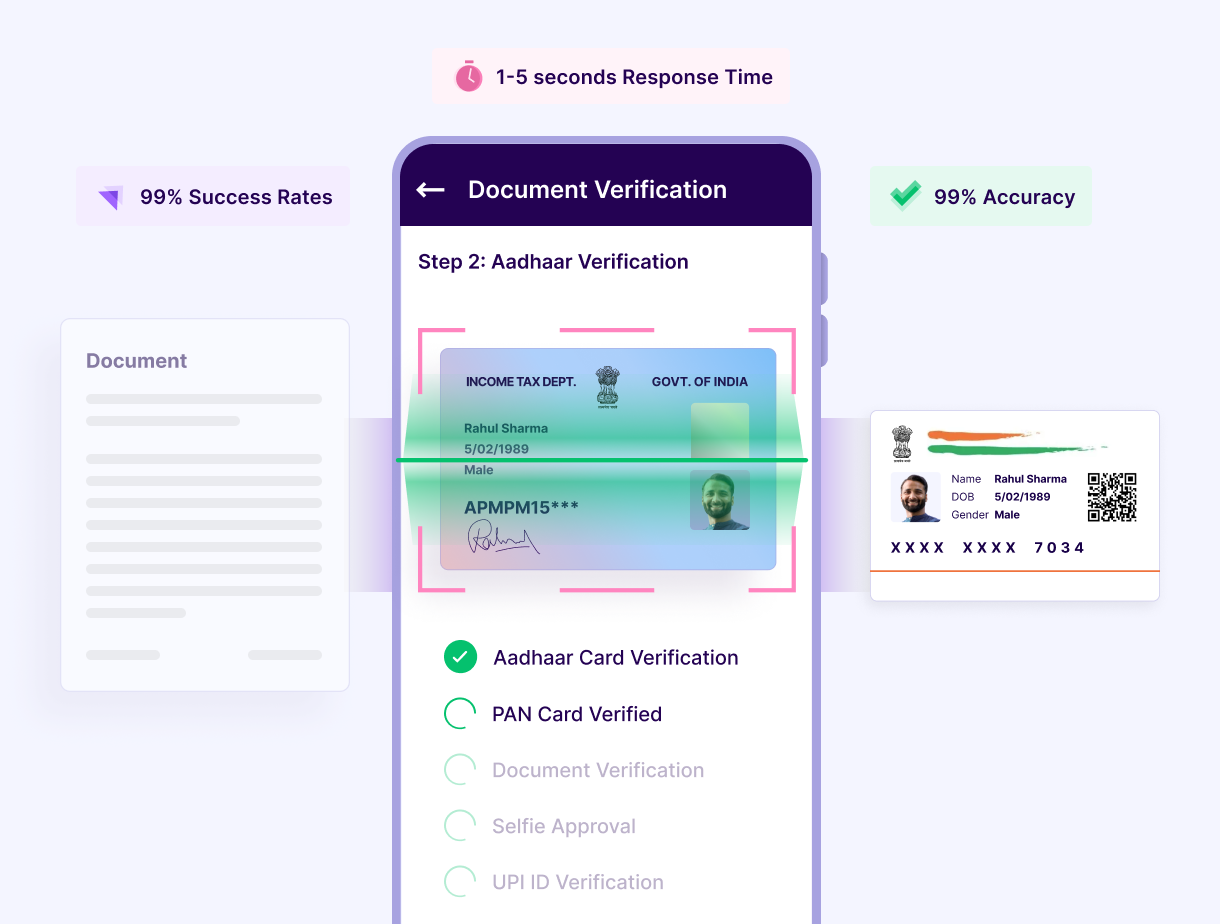

Perform real-time identity verification against updated databases

Explore a vast range of APIs for Proof of Identity, Address, Age and Employment

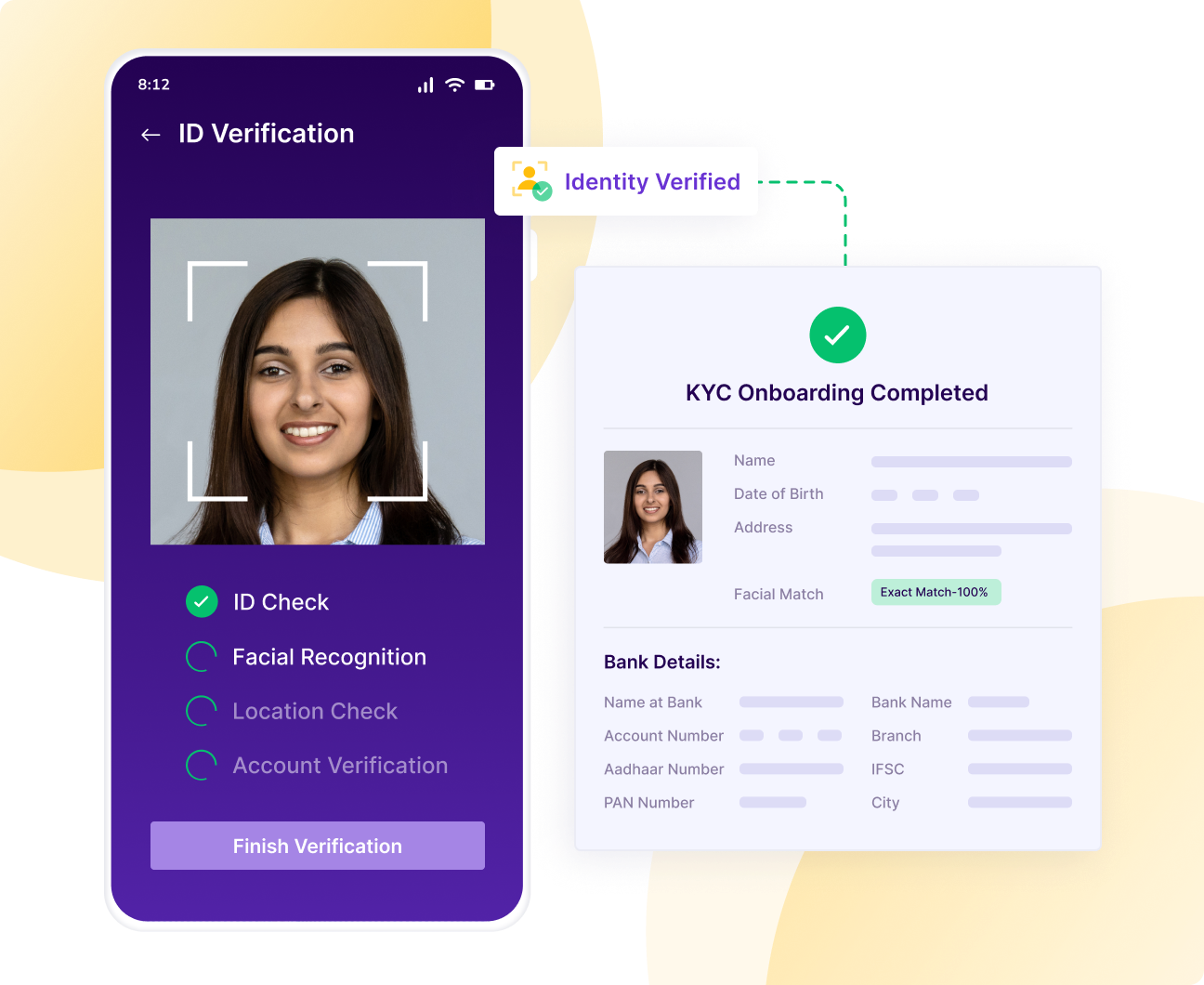

Authenticate users with Facial Recognition APIs and Live Location Check

Onboard users fast backed by high success rate and accuracy rate

Reduce onboarding and manual verification costs

Manage verification traffic and navigate downtimes with our robust infrastructure

Stay compliant with regulatory requirements and KYC Master Direction

Bank-grade data security ensured

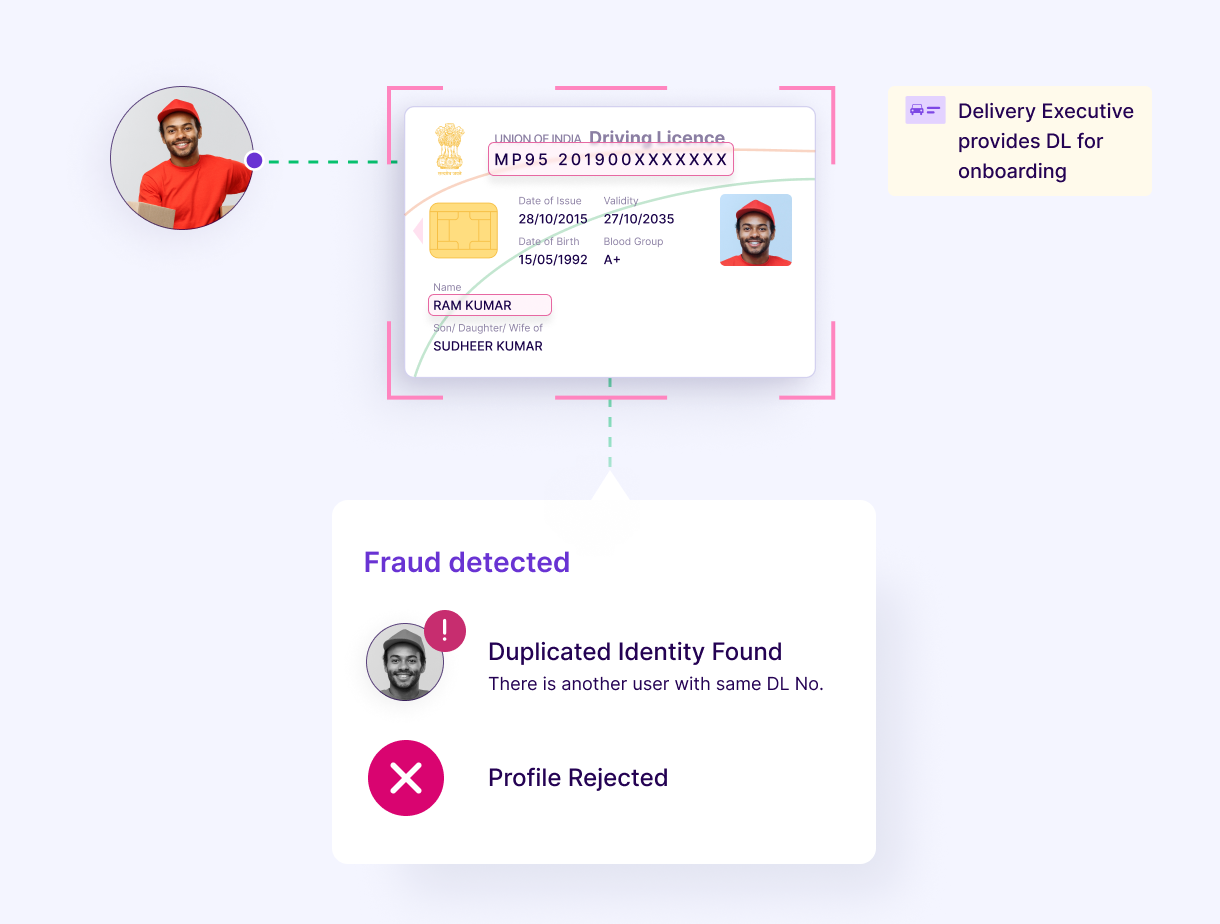

Screen out fraudulent actors at source

Safeguard your business, and customers against identity theft

Ensure the highest standards of security

Discover More

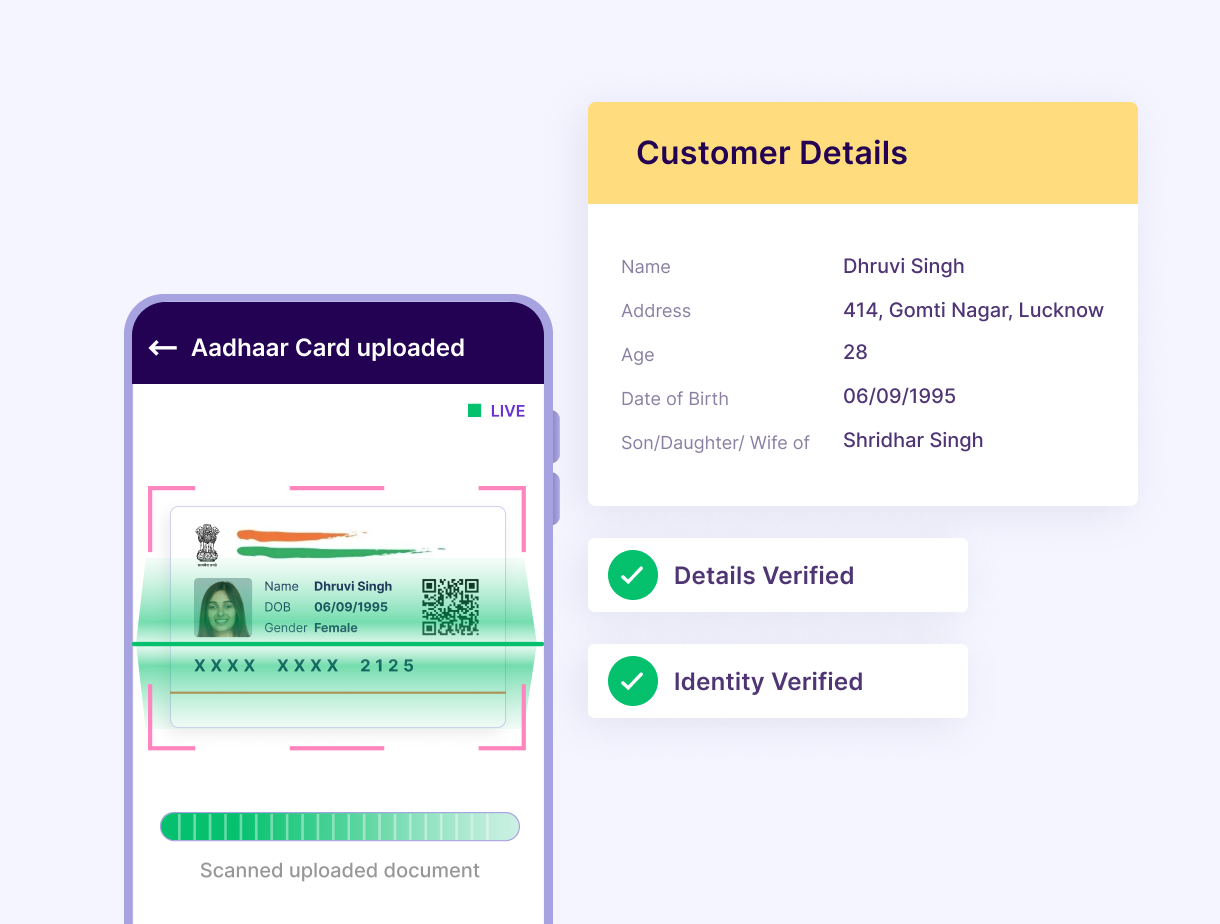

Verify Aadhaar of users instantly via OTP flow for user consent

Mask the first eight digits and block QR code of Aadhaar Card before storage

Scan Aadhaar Card images to fetch and pre-fill details during onboarding

Gain consented access to users' Aadhaar Card stored in DigiLocker

Send, track, and request Aadhaar-holders to eSign documents

Verify provided PAN of an individual or business in real-time

Scan PAN card image to fetch and pre-fill details during onboarding

Authenticate Driving License Number during onboarding and background checks

Verify EPIC number and fetch complete details including assembly and parliamentary constituency details

Verify Passport File Number and DOB, during onboarding and background checks

Compare faces between two images or IDs via our AI-powered solution

Verify if the customer is genuine and screen out spoofs, frauds and bots instantly

Convert a given pair of latitude and longitude to get a readable address location

Verify bank accounts details and account-holder name, with high accuracy

Digital Onboarding Solution Empowering All Businesses

Ensure compliance and secure investor authentication to prevent fraudulent activities

Quickly verify borrower identities to reduce the risk of default and fraud

Authenticate policyholders to streamline claims processing and minimize fraud

Verify user identity, ensure payouts to the right beneficiaries and enhance user experience

Confirm buyer and seller identities to enhance trust and security in transactions

Accurately verify candidate identities to ensure a trustworthy hiring process and faster employee onboarding

Securely verify customer identities to comply with KYC regulations

Confirm user identities to enhance platform trust and safety

Verify player identities to comply with regulations and prevent underage access

Instantly integrate powerful APIs with your product using only a few lines of code and automate the onboarding process.

Highly reliable and secure APIs

Choose from different programming languages to integrate with your product using the proprietary Cashfree Payments libraries

Get notified on single or bulk verification status in real-time with webhooks

Explore and experiment with Verification APIs on Cashfree DevStudio

{

"status": "SUCCESSS",

"subCode": 200,

"message": "Bank account details verified successfully",

"data": {

"bvRefId": 123456,

"nameAtBank": "JOHN DOE",

"accountExists": "YES",

"bankAccount": 26291800001191,

"ifsc": "YESB0000262",

"utr": 12341234123,

"nameMatchScore": 100,

"nameMatchResult": "DIRECT_MATCH"

}

} Have more questions?

Have more questions?

Visit our support pageReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access