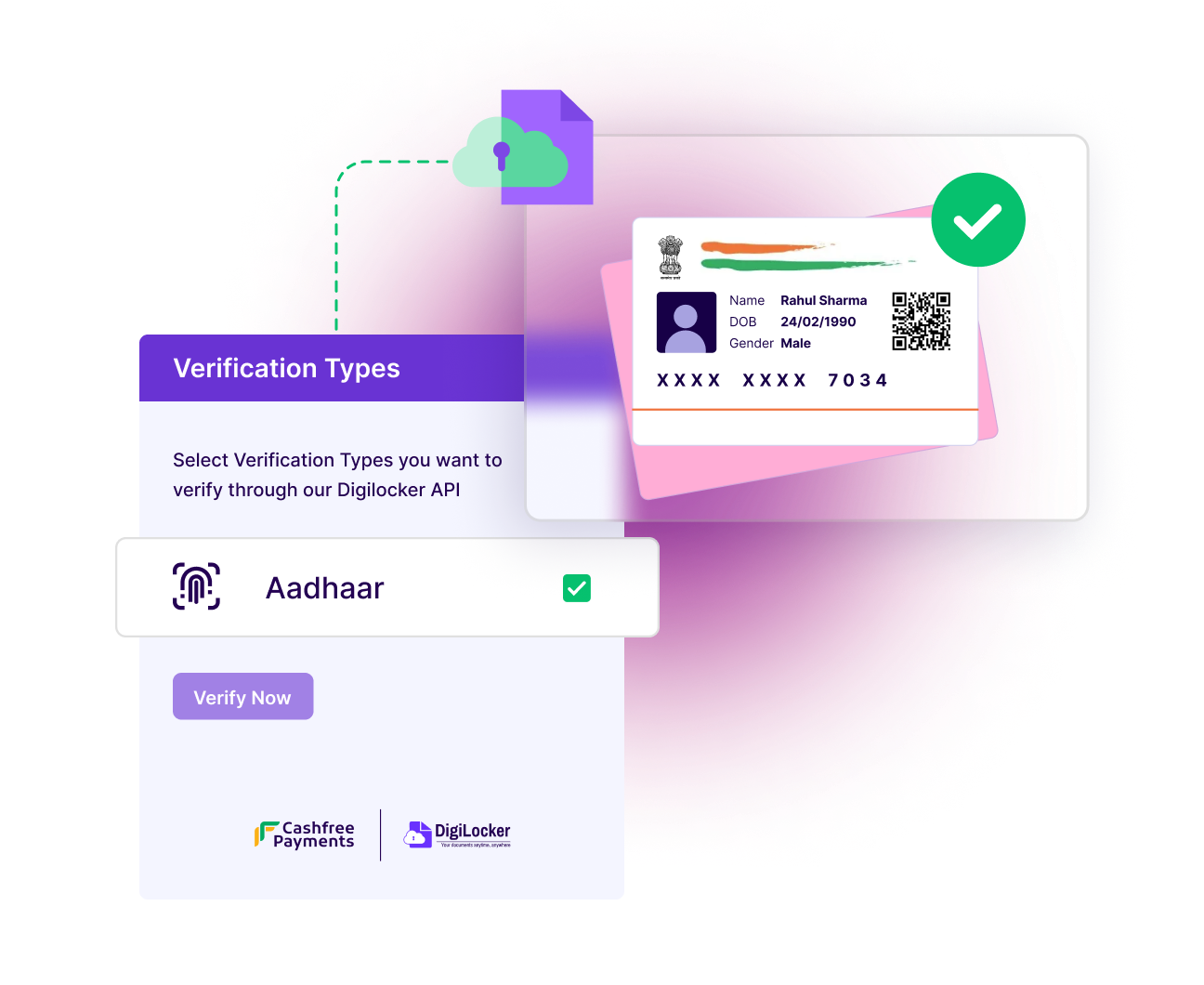

Fetch documents from DigiLocker

Redirect users to DigiLocker for OTP-based verification followed by instant and seamless document access. You can verify documents, right from our dashboard via the self-serve feature or integrate the DigiLocker API on your platform.

Create Account

Plug And Play API

Fetch in real-time

100% Compliant

Widen Reach

Fraud Prevention

Step 1

User Login

User enters Aadhaar number, OTP, and security PIN in your app that has our DigiLocker API.

Step 2

Retrieve Document

User allows consent to share the given DigiLocker document with Cashfree Payments.

Step 3

Get Details

Get instant results in the form of comprehensive details fetched from the verified document, via the DigiLocker API.

Streamline KYC process, allow faster account opening, and secure account access for new applicants.

Verify identity and accept documents during onboarding and before disbursing insurance processing amounts.

Do Aadhaar Verification and Driving License Verification via DigiLocker for drivers and delivery partners.

Streamline KYC verification for quick customer onboarding. Access Government-issued documents like Aadhaar and PAN.

Fast-track user onboarding and validate identity for KYC verification, loan sanctions, mobile wallets etc. Validate users’ Aadhaar and PAN as per compliance.

Ensure frictionless onboarding and verify users' details from government documents like Aadhaar and PAN to onboard only reliable and genuine clients.

Have more questions?

Visit our support pageHave more questions?

Visit our support pageSecure ID

Onboard users seamlessly with our compliant and highly customisable 360° identity verification platform

Learn MorePayouts

Easiest way to make payouts to any bank account, UPI ID, card, AmazonPay, Paytm or other native wallet 24*7 instantly even on a bank holiday.

Learn MoreSubscriptions

Accept recurring payments by auto-debiting customer’ accounts via standing instructions on cards or UPI e mandate.

Learn MoreReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access