Cashfree turns 10! Celebrate with 1.6%* gateway fee for new merchants – limited period!

FOR BUSINESSES

Create bank accounts for your users in minutes

100% paperless online KYC. No user site visits required. *

Offer the most modern banking experience within your product. Give your customers the ease of operating and managing a fully digital bank account.,

Set rules for funds transfer, withdrawals, block funds etc. It's easy to stop, pause or modify these rules too!

Earn revenuefrom deposits generated.

*In case of current account opening, banks may perform physical verification

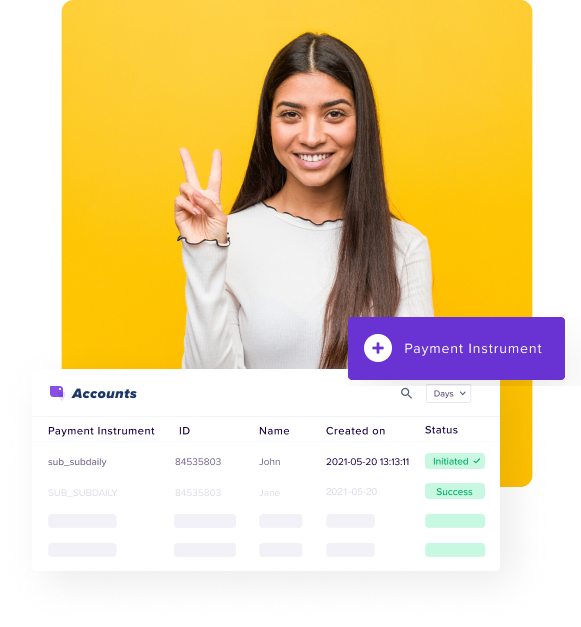

Integrate Cashfree Accounts into your product using our APIs

Cashfree partner banks will show up on your app

Your user can select the preferred bank, enter name and upload identification documents

Cashfree authenticates KYC details at the backend by calling banks API

On successful verification, an account is created for your user within 30 seconds

Users can use their accounts through your product to accept deposits, make payouts, check balance and earn interest

FOR USERS

Supercharge banking experience with connected banking

We have partnered with the best to offer the best connected banking experience to your users.

Let your users add their existing bank accounts to your product and do instant payouts without visiting the bank portal.

Benefits for users

Open bank account. No bank visits required. **

Link multiple existing bank accounts and access accounts from a single platform

Check balance of all connected bank accounts

Add money and earn interest

Make instant money transfers

** In case of current account opening, banks may perform physical verification.

Why Cashfree Accounts?

We have done complex integrations with leading banks so that you don't have to invest in bank integration, compliances and other operational processes. When you use the Accounts API, Cashfree interacts with our partner banks servers and create a new account within minutes

Our developer friendly REST APIs are easy to integrate and offer the utmost security. The APIs are built to help you scale and support upto 2000 account creation requests per second. The APIs also offer flexibility in building other solutions over the stack we have provided.

Get notified in real-time on all the activities related to accounts creation, money transfer and other day-to-day operations.

Cashfree partners with the best to secure your and your user's money. Our partner banks host your user bank accounts and follow all security standards, as per RBI regulations. Further user money is insured upto ₹5 lakh as per the RBI's insurance deposit scheme with our partner banks.

Explore more in payments and banking from Cashfree

Payouts

Fastest and easiest way to send money to any bank account/ UPI ID/ Wallet or cards, instantly 24x7, even on a bank holiday.

Learn moreBank Account Verification

API to check if bank account or UPI address exists and name of holder

Learn moreAutocollect

Automatically track customer payments with virtual bank accounts. No more manual reconciliation.

Learn morePayment Links

No-code payment links to collect payments over WhatsApp, SMS, Facebook, Twitter and other channels

Learn moreHave more questions?

Cashfree is a financial technology company, not a bank. Banking services will be provided by our banking partners - ICICI Bank and Yes Bank. Your and your users bank account and all transactions on the bank account will be managed by our partner banks.

Cashfree is a financial technology company that enables tech platforms including neo banks, to embed the functionality of instant bank account creation into their product by integrating with Cashfree Accounts APIs.

Traditionally, neo-banks don't have a bank license of their own but count on bank partners to provide bank licensed services including bank account opening.

We enable neo banking companies to open accounts for their users across various banks without having to do any direct integration with banks.

In a nutshell, Cashfree helps neo banks with the building blocks to build and offer digital and mobile-first financial solutions like money transfers, payments, expense management, money lending, and more.

Yes, the accounts opened using Cashfree are opened with our partner banks which are covered under insurance by deposit insurance and credit guarantee corporation (DICGC). Each depositor in a bank is insured upto a maximum of ₹ 5,00,000 for both principal and interest amount held by him.

Click here to register for early access. Our payments expert will connect with you within 24 hours and help you explore how you can use Cashfree Accounts for your business model.

Have more questions?

Visit our support pageReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access