Cashfree turns 10! Celebrate with 1.6%* gateway fee for new merchants – limited period!

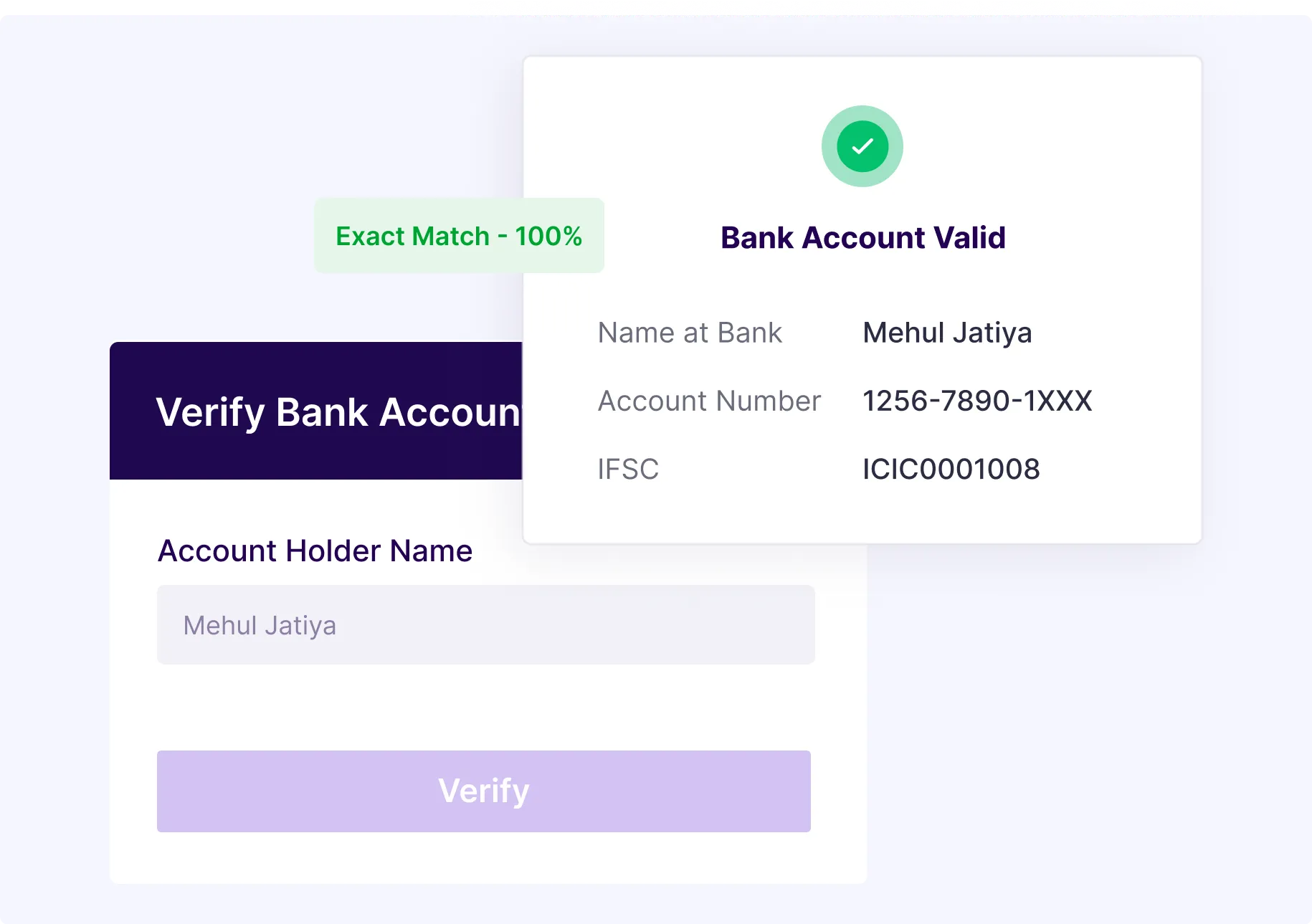

Bank Account Verification

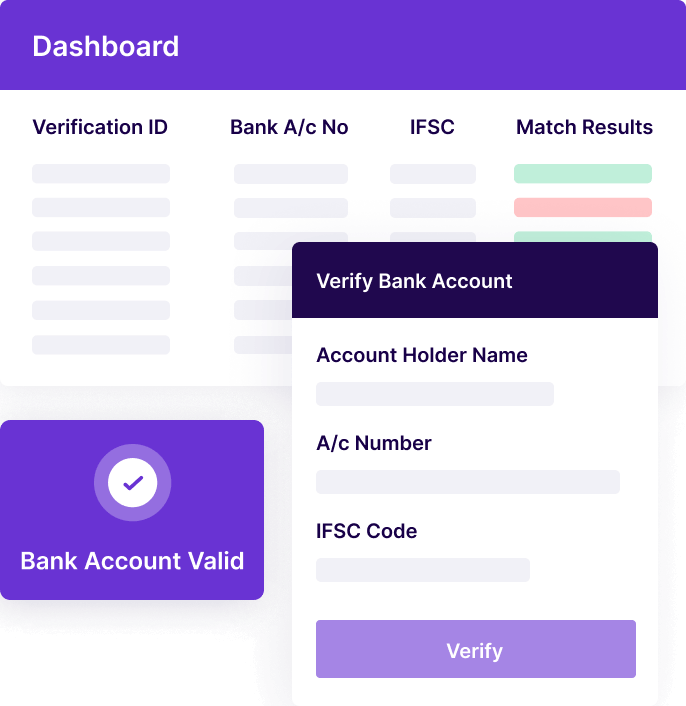

Verify bank account details instantly

Verify bank accounts

and holder name during onboarding KYC and before making payouts.Complete account verification suite:Bank account

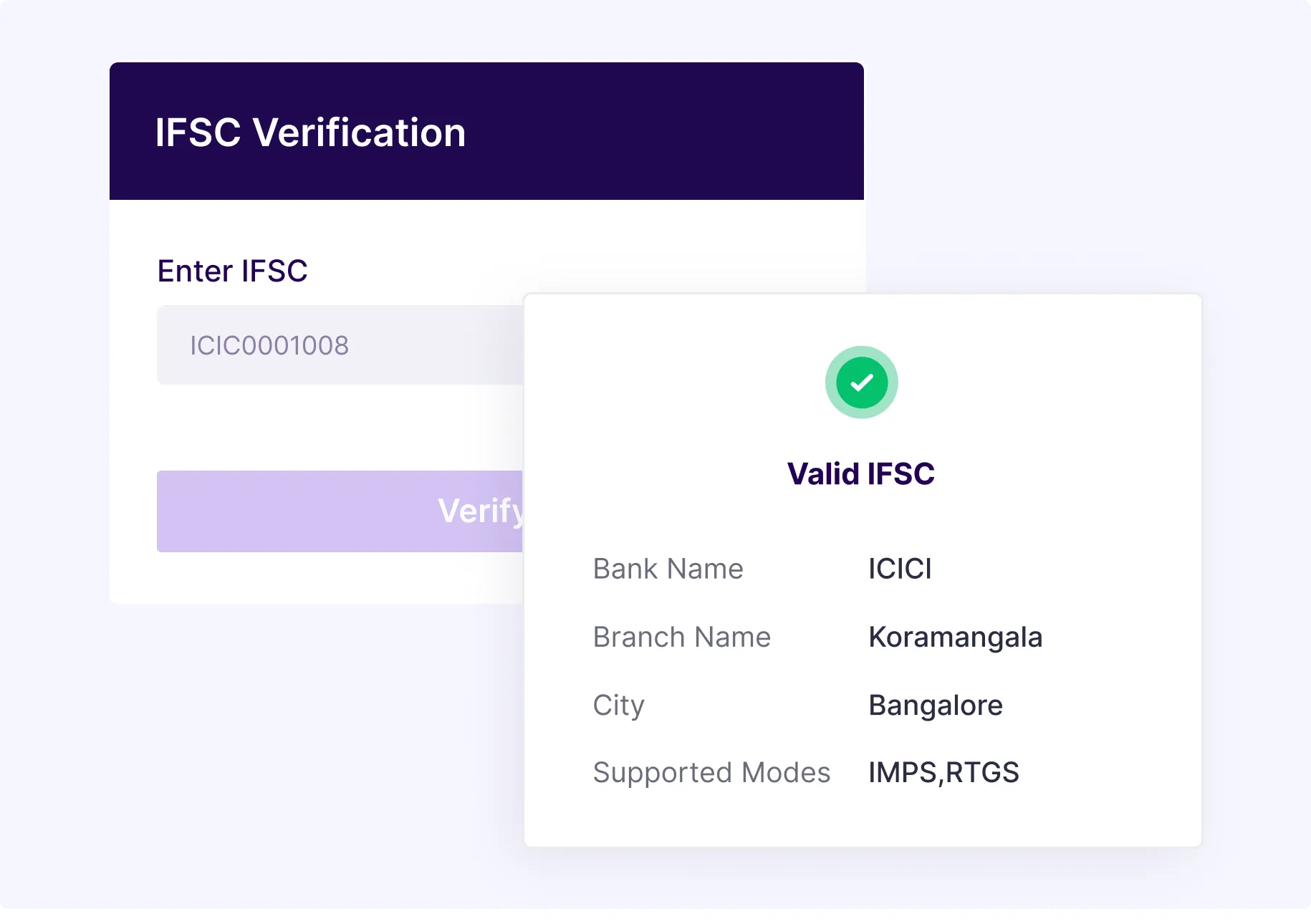

IFSC

Validate the accuracy of bank account details

Match the name with account holder name

Verify if the IFSC is correct

BANK ACCOUNT VERIFICATION

Instant Bank Account Verification

Verification support for accounts of 600+ banks

Verify beneficiary accounts

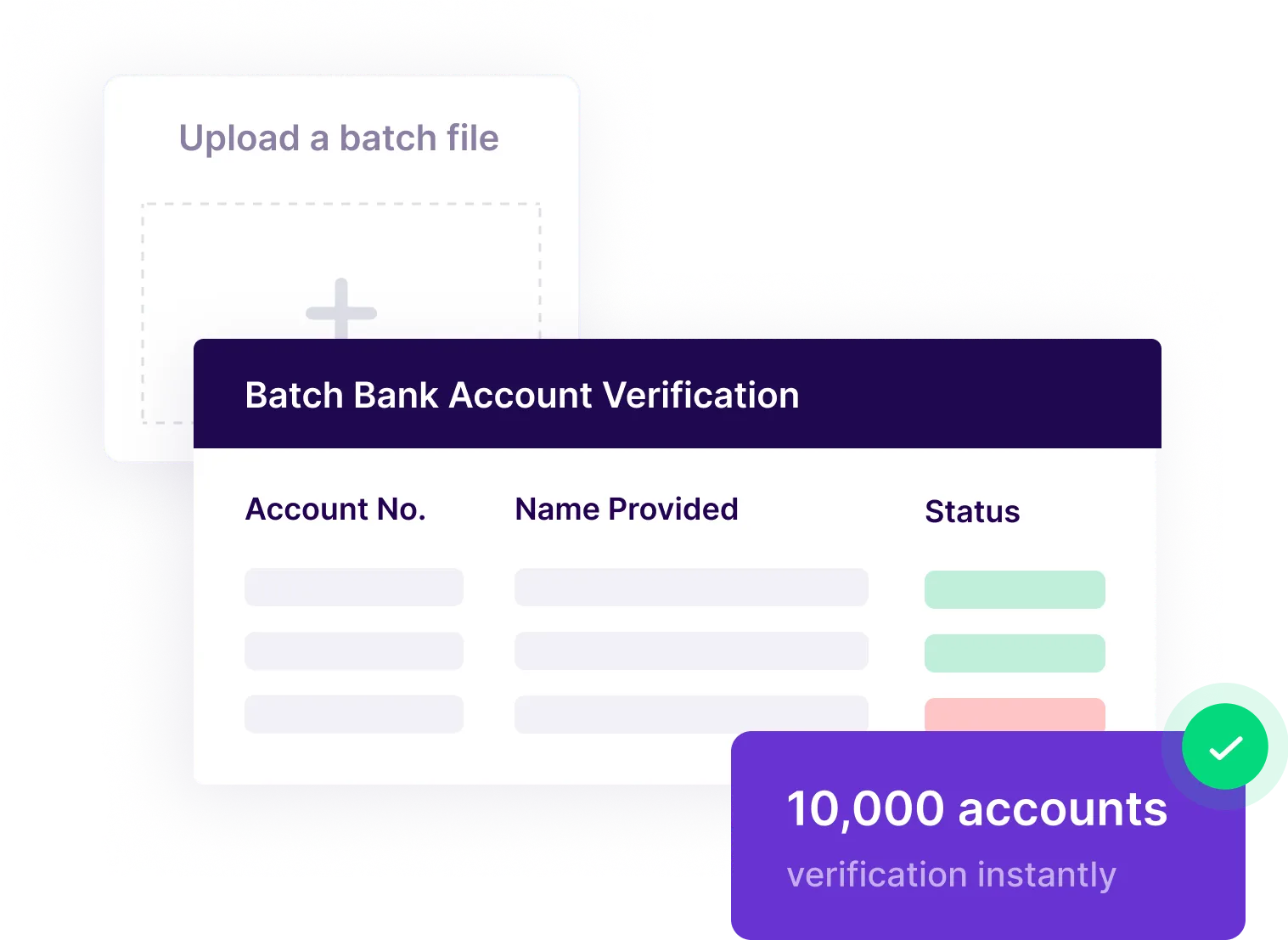

, account holder name and IFSC codes for 600+ banks including public, private, rural and cooperative banks.Bulk Bank Account Verification

single Bank Account Verification

or upto 10000 bank accounts in one go, via excel upload or APIs.Beneficiary name verification

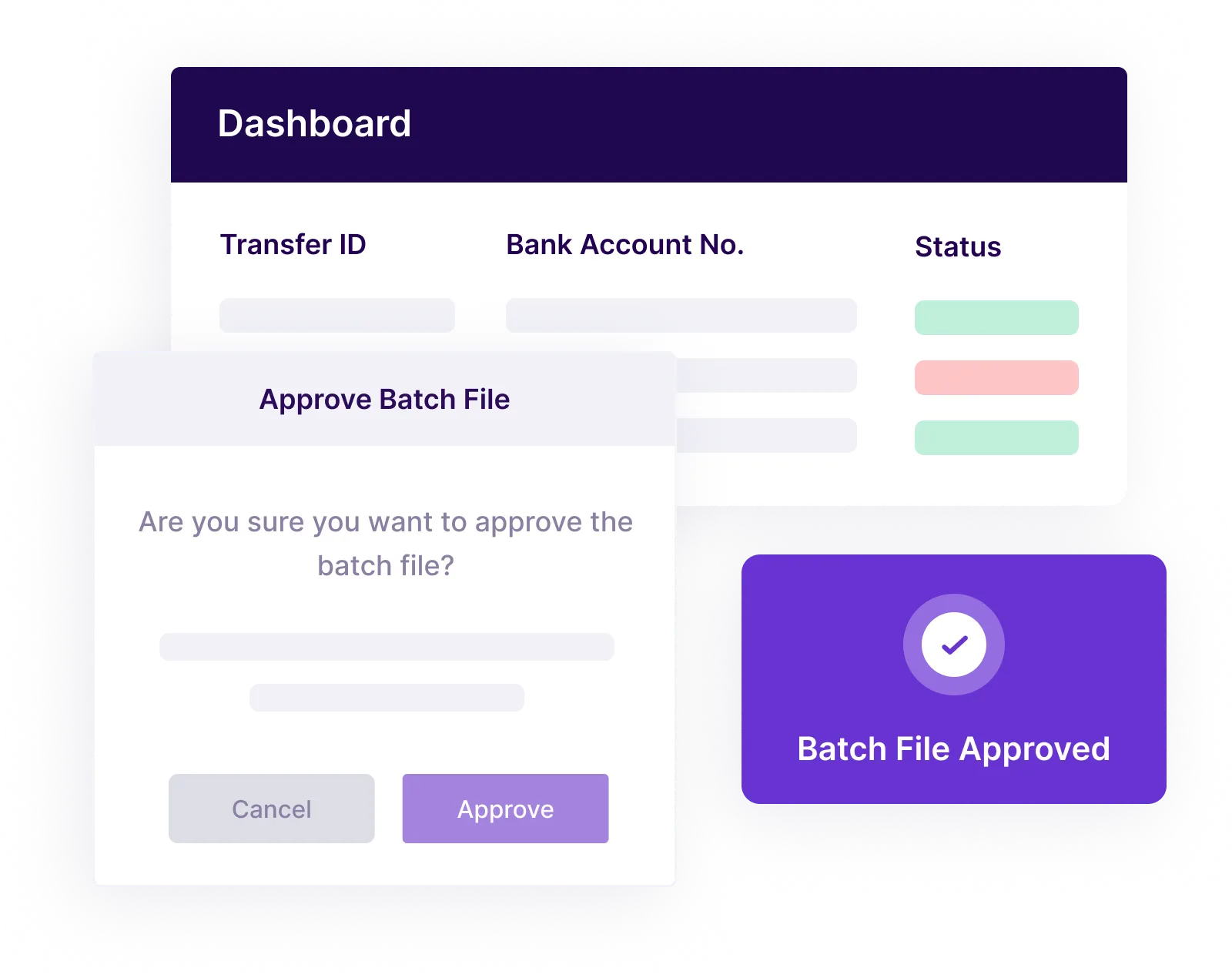

Inbuilt approval flow

BUILT FOR ENTERPRISES

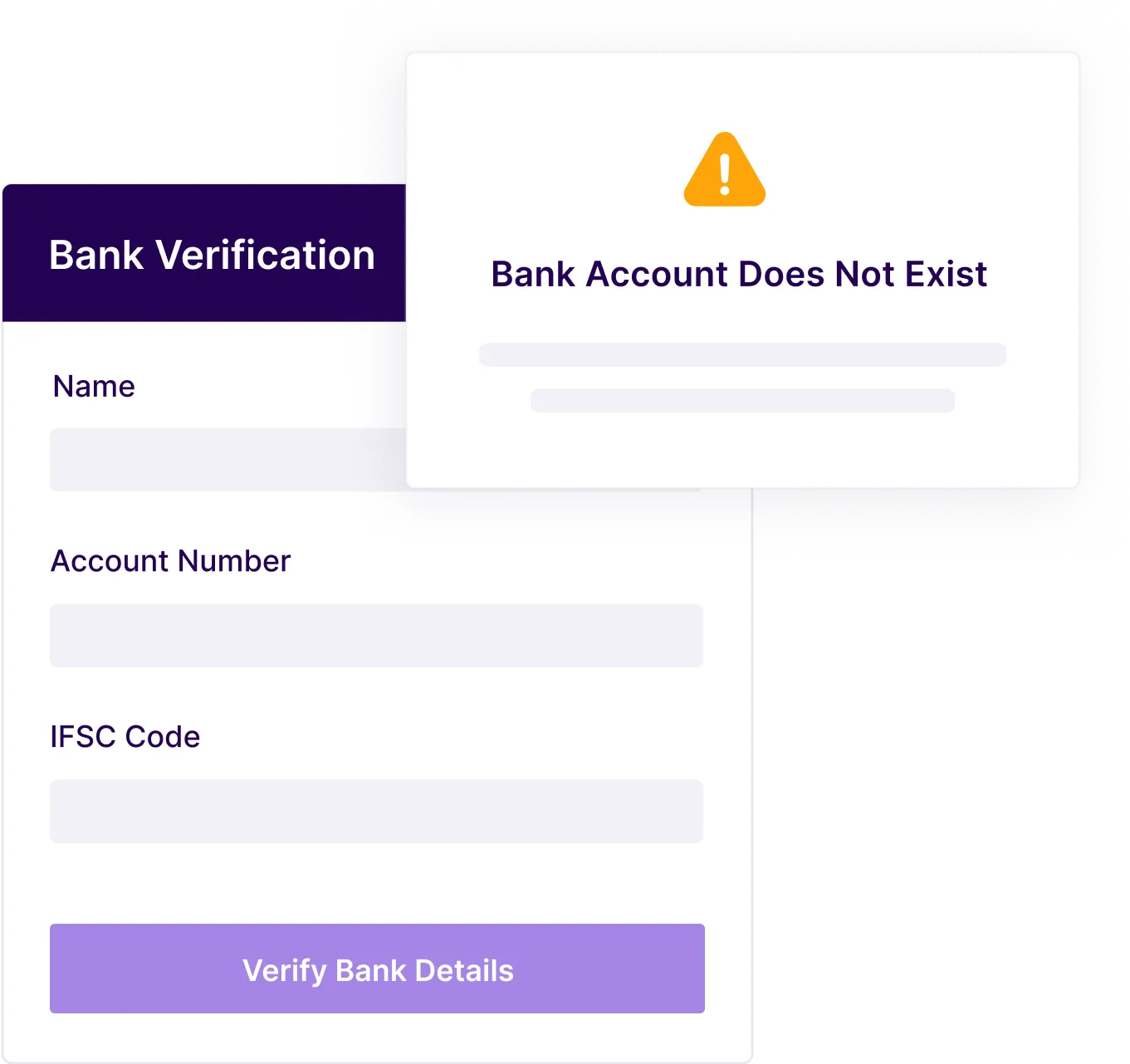

Verification can fail due to reasons like invalid account number, incorrect IFSC, blocked, frozen or closed account. Know exactly why verification failed in real time.

Do 10,000 account verifications using powerful API or bulk upload via simple excel sheet. Verify without exposing sensitive financial data to any third-party.

Add users (Maker and Checker) to your account, and control the permissions. Every time a Maker uploads a file to do batch verification, the Checker(s) can review the files individually, and mark each record as valid or invalid and approve or reject the file.

Marketplaces

Verify user’s and vendors and ensure that the Payout amount is credited to intended beneficiaries only.

Businesses and individuals for payment verification

Verify the bank account details and match the name registered at the bank to avoid any transfer failures or reversals.

Payments and fintech companies

Ensure frictionless onboarding, Verify users details at the bank to avoid details mismatch or failed transactions.

Insurance providers

Authenticate individuals and users during onboarding or before disbursing the insurance amounts.

Wallet service providers

Fastrack user onboarding and account activations with Instant users/businesses account verifications.

Security and equity investment platforms

Enable users to start invertmenting on your platform faster with Bank Account Verification. Integrate APIs that are highly customisable and easy to use.

Lending Platforms

Verify the bank details before disbursing the loan to ensure zero transfer reversals or failures due to incorrect account number.

Recruitment and identification verification companies

Verify the bank account details and match the name of employees for a faster onboarding process and minimize failed transfers.

integrate Bank Account Verification API

Bank Account Verification APIs

with your product using only a few lines of code and automate the onboarding process and ensure successful payouts with Cashfree Payments.Highly reliable and secure Bank Account Verification APIs

Use the official Cashfree Payments libraries for different programming languages to integrate with your product and automate account verification flow

With webhooks, get notified on single or bulk verification status in real-time

curl

--request GET

--url https://payout-api.cashfree.com/payout/v1.2/validation/bankDetails

--header 'accept: application/json'

No code solutions

Do single Bank Account Verification or do upto 10,000 accounts verification by using simple excel upload

Just enter the beneficiary's account number/IFSC and get instant response

Use cases for various industries

Bank Account Verification for innovative businessesVerify bank account details

before onboarding and validate accounts before making payouts with Cashfree Payments.

Bank account Verification

IFSC Verification

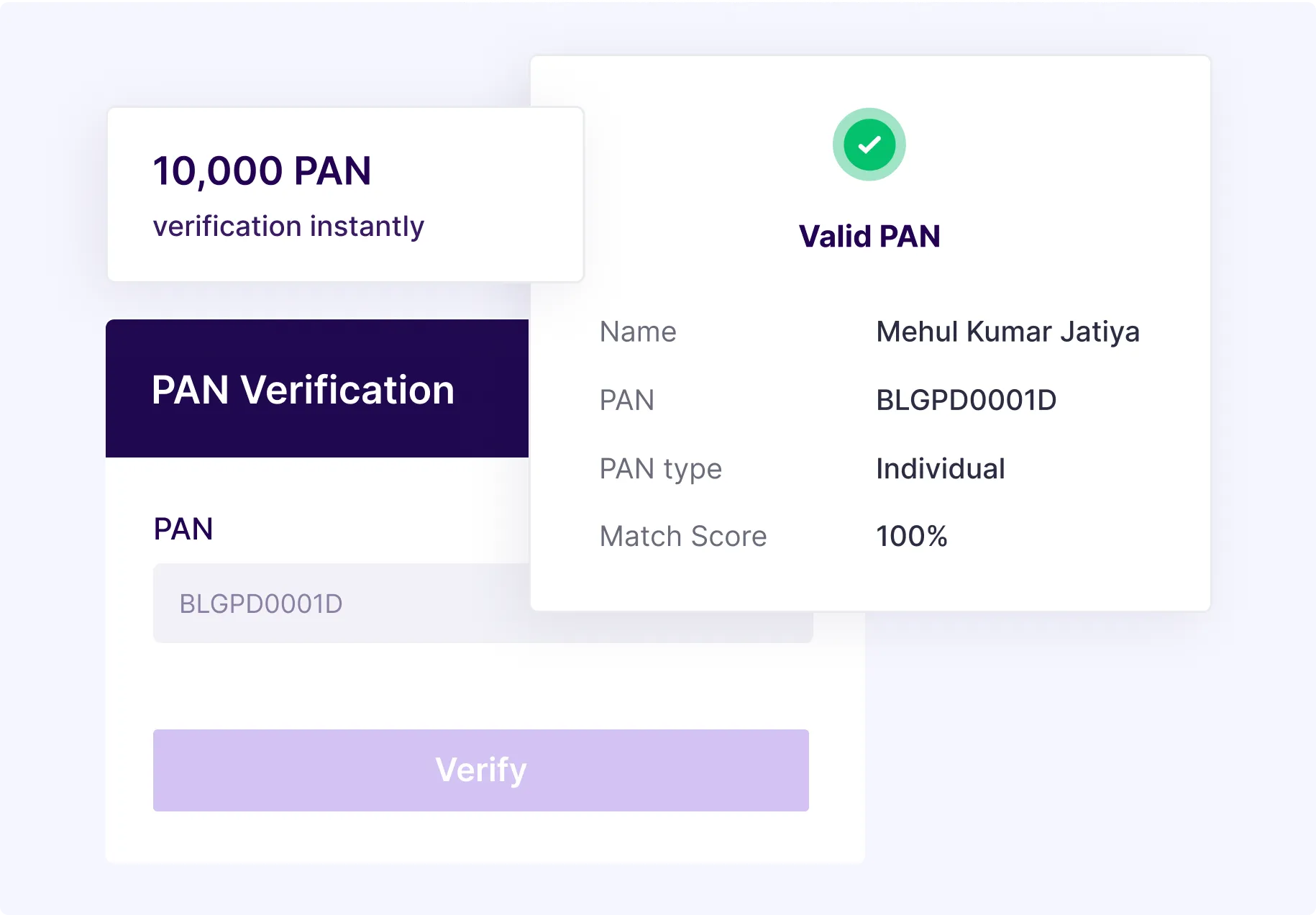

PAN Verification

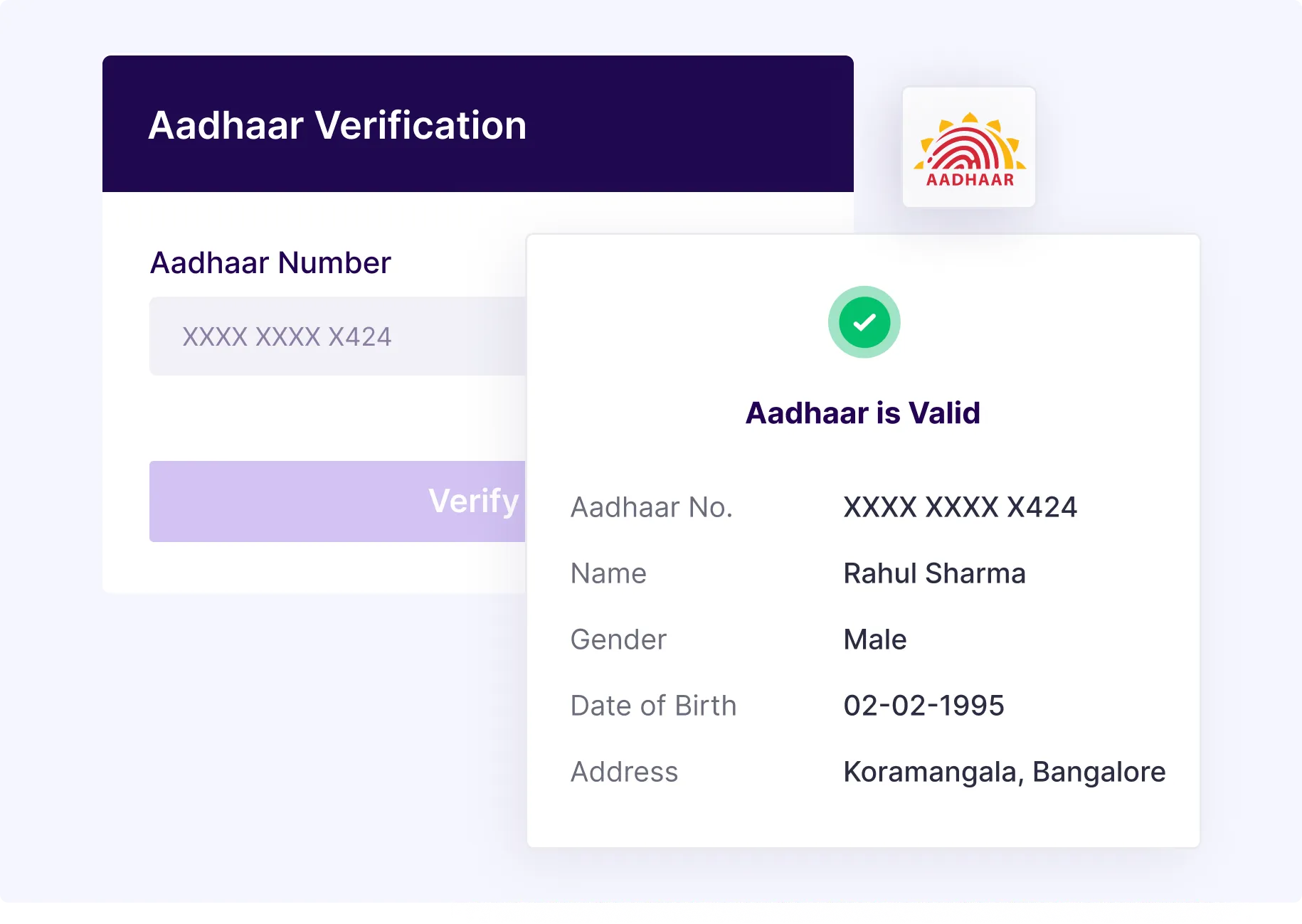

Aadhaar Verification

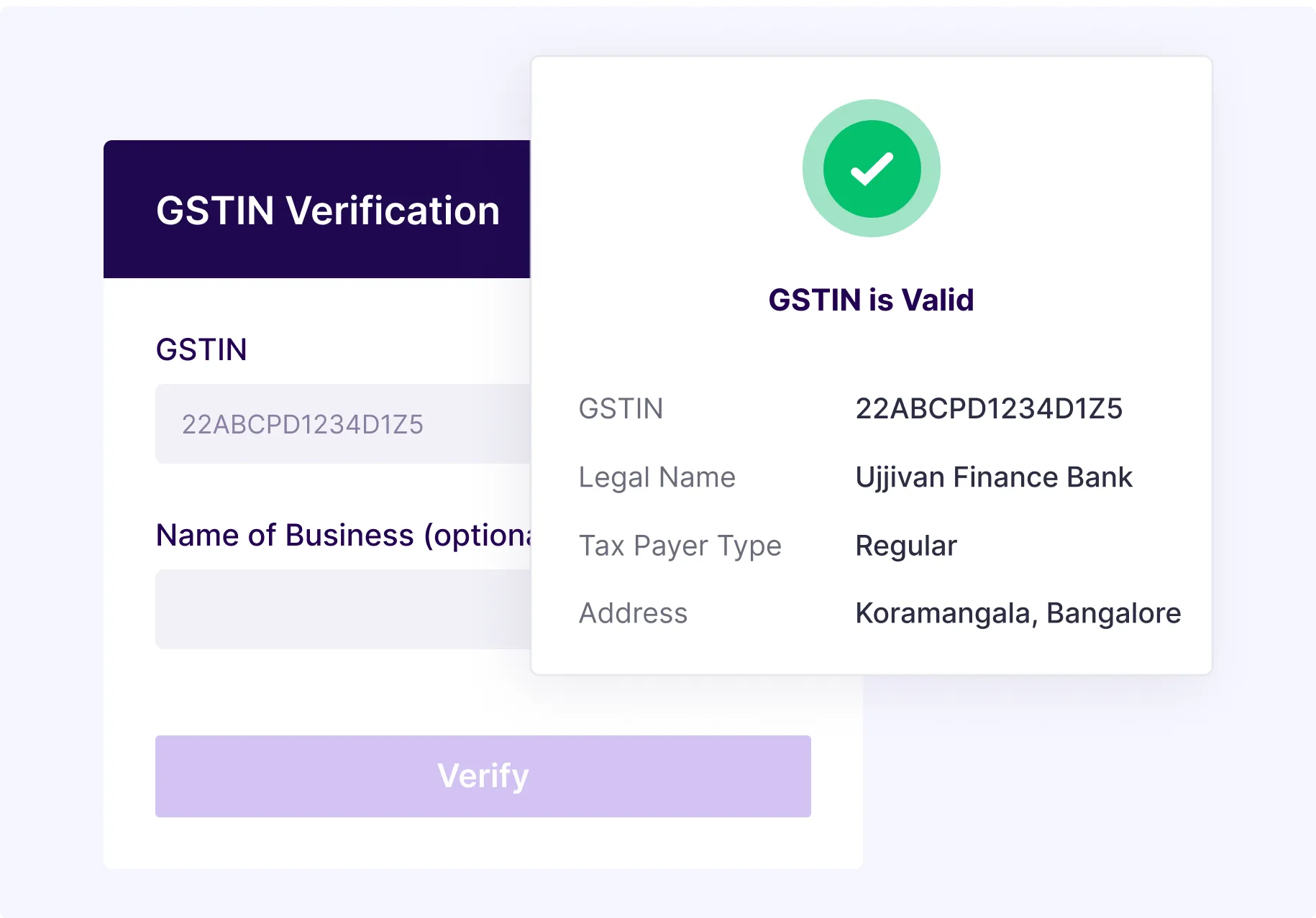

GSTIN Verification

PRICING

Custom pricing designed for enterprises

Early access to new features

Dedicated account manager

Discounted pricing

Support over WhatsApp in addition to other channels

Get in touch with our sales team to explore the right product(s) for your payment needs and get custom pricing.

API Integration

Make payouts to any bank account/card/AmazonPay/Paytm instantly even on a bank holiday.

Payout links enable you to send money without the receiver’s bank account details. Verify the beneficiaries' account number to ensure money is credited to intended beneficiaries only.

Use Easy Split to seamlessly split commission and disburse payments to all partner vendors after every sale, and reconcile with ease. Run a marketplace with ease.

Have more questions?

Visit Our Support PageOn Cashfree Payments you can verify a/c numbers instantly. As you submit the request, our API gives an instant response.

The verification can be done for all the a/c of recognized Indian banks including all public banks, private banks, and 126+ co-operative banks*.

Note: Verification may not be possible for some co-operative bank a/cs.

On Cashfree Payments, you can do verification for any number of Indian bank accounts via two modes:

- Manual entry on Cashfree Payments Bank account verification dashboard. Here you will be required to enter only two details: Indian bank account number and IFSC. If you want to do bulk verification, you can access the bulk upload feature on the dashboard where you can upload a csv/xslx file with required details and get a quick response.

- Using API This is an integrated automated way to do single/bulk verification. The API can be integrated with existing company internal system or ERP and then request can be pushed directly using API.

No, there is no such limit. You can use the fetaure to verify any number of a/cs in a day 24*7.

KYC or “Know Your Customer” is a process to be undertaken by businesses especially financial institutions to obtain information about the identity and address of the customers. One of the key document is bank account details as the same is regarded as valid proof for the identity of a person/entity.

While onboarding vendors, delivery partners, or even employees, an organisation needs to do a bank account verification. Using Cashfree Payments API, this process can be automated and integrated with existing company internal system so that the bank verification process happens smoothly, without exposing the data to any third party. You can also verify PAN, Aadhaar and GSTIN of users or businesses with our Verification Suite.

The capability to verify a/c can be used in multiple business scenarios such as

- Crucial part of verification process before providing loans of all kind (health,business,car etc)

- Employee background check : a recruitment agency can use the feature for candidate's background check

- Vendor onboarding: a marketplace splitting commission with different vendors can use the feature to verify the a/c details at the time of onboarding the vendor, this also helps in correct payments later on. The ability to integrate the API with existing ERP helps in reducing operational effort and saves cost.

Yes, Payouts is different. Payouts user can integrate BAV to do the validation & will be charged separately.

Yes, if you are using Cashfree Payments marketplace settlement and want to use verification API as well, you need to opt for the feature seperately. Our experts will help you with integration and you will be able to use Cashfree Payments marketplace settlement and verification feature together.

Our Plug and Play integrated a/c number verification API helps you confirm bank account validity. By accessing updated data, the risk of identity fraud and incorrect/incomplete data is reduced. The result such as account holder’s name shown to you will be exactly as it appears in bank records.

Have more questions?

Visit Our Support PagePayouts

Make payouts to any bank account / UPI ID / card/ AmazonPay / Paytm instantly even on a bank holiday.

Learn MoreAadhaar Verification

Instantly verify Aadhaar details of users with consent-based verification flow.

Learn MorePAN verification

Verify the validity of user's PAN along with cardholder details, at scale.

Learn MoreReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access