INTERNATIONAL PAYMENTS

Accept International Payments

for your businessReceive international payments

in India with Cashfree Payments’ leadinginternational payment gateway

. Accept payments from customers abroad in their own currencies and give them the best checkout experience.Worldwide Acceptance

Currency Flexibility

Secure checkout

Cross Border Payment solutions

Receive international payments

with Cashfree PaymentsInternational Payment Gateway

International Payment Gateway

enables you to accept payments from across the world in 100+ currencies through all major international cards directly on your website.Global Collections

Receive International Payments

seamlessly with Cashfree’s Global Collectionscross-border payments

by enabling you to get local accounts for USD, EUR, CAD, and GBP. Use our Global SWIFT Account to accept payments in 30+ currencies from 180+ countries.International Payment Gateway

is designed to cater businesses of any scale and across diverse industries, ensuring seamless transactions for all.International Payment Gateway

Global Collections

International Payment Gateway

Global Collections

Do not worry, we have got you covered! Talk to our team.

Lowest Pricing

international payment gateway

charges in IndiaAccept online payments in Indian Rupees (INR) and other 100+ foreign currencies with minimal integration effort and go live in no time.

No setup, maintenance or any other hidden fees

Pay only for actual transactions

Real-time transaction fees reporting

Paperless and same day onboarding

Custom pricing designed for enterprises

- Early access to new features

- Dedicated account manager

- Discounted pricing

- Support over WhatsApp in addition to other channels

Get in touch with our sales team to explore the right product(s) for your payment needs and get custom pricing.

Success rates elevated by up to 20%

Receive payments with a T+2* settlement cycle

Connect with over 30 Crore PayPal users worldwide

Transactions will be charged as per rates defined by PayPal

Have more questions?

Visit our support pageCashfree Payments’ International Payment Gateway comes equipped to enable you to accept payments from across the world without any additional effort. You can start accepting payments in 30+ currencies from 200 countries across the world via PayPal or through international cards after onboarding with us. You can check if International Cards are enabled on your Cashfree PG account by going to Settings ->Payment Methods (under Payment Gateway) and seeing if International Cards are enabled for Credit and Debit Cards on your account. To enable PayPal on your account, scroll down and click ‘Connect Account’ under PayPal, enter your PayPal credentials, and get started. Once these modes are activated, you will be able to receive payments from international customers via their credit and debit cards, or via PayPal.

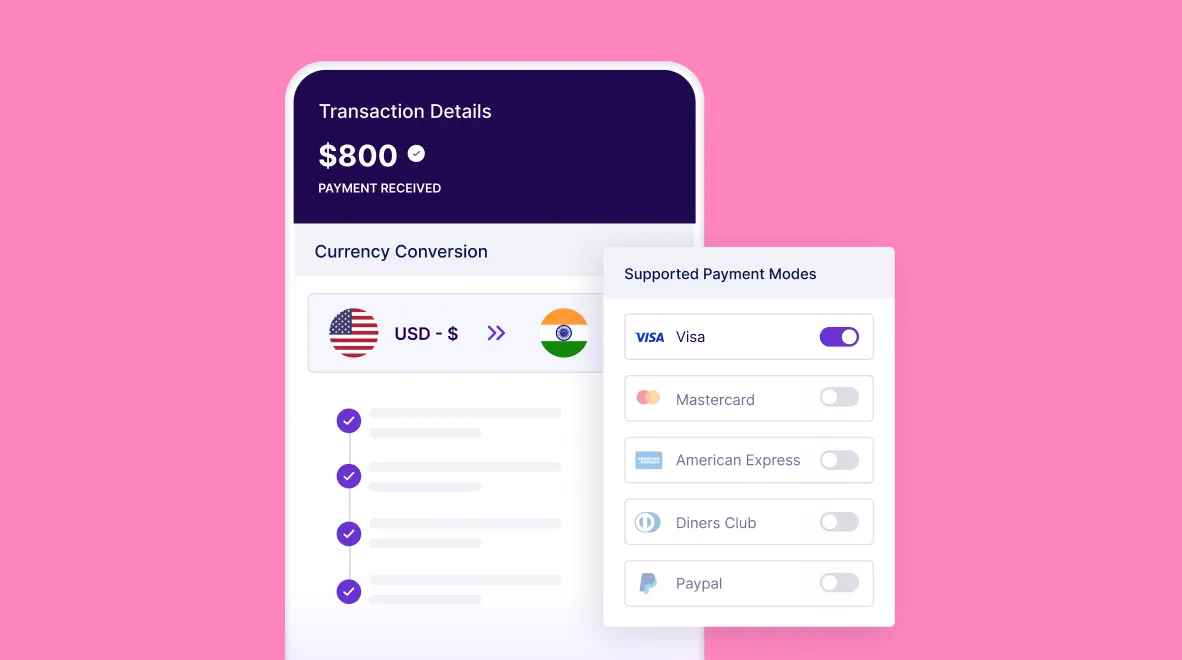

Businesses on Cashfree Payments can accept payments from international customers via their credit and debit cards (Visa, Mastercard, American Express, Diner’s Club), or via PayPal. We are also working to add additional alternate payment methods so that your global customers can see payment modes that are local and familiar to them.

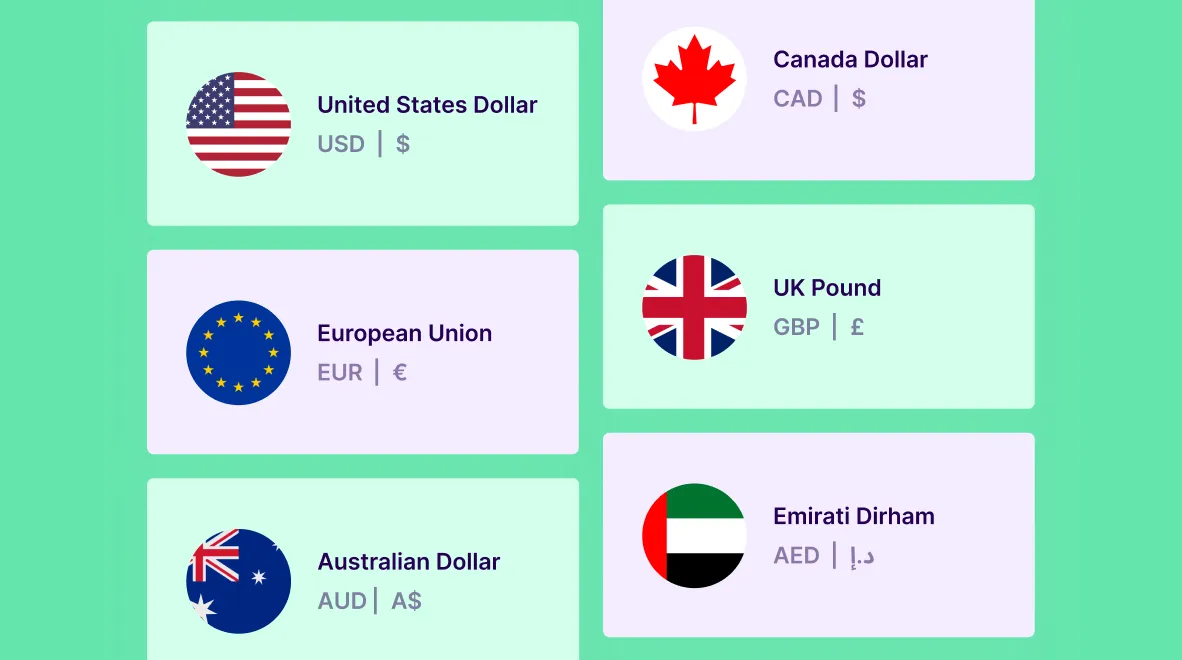

With Cashfree Payments, you can accept payments in a variety of foreign currencies and receive the settlement in INR in your account without any additional effort.We support the following currencies -

- Australian Dollar (AUD)

- Brazilian Real (BRL)

- Canadian Dollar (CAD)

- Chinese Renmibi (CNY)

- Czech Koruna (CZK)

- Euro (EUR)

- Hong Kong Dollar (HKD)

- Hungarian Forint (HUF)

- Israeli New Shekel (ILS)

- Japanese Yen (JPY)

- Malaysian Ringgit (MYR)

- Mexican Peso (MXN)

- New Taiwanese Dollar (TWD)

- New Zealand Dollar (NZD)

- Norwegian Krone (NOK)

- Philippine Peso (PHP)

- Polish Zloty (PLN)

- Pound Sterling (GBP)

- Singapore Dollar (SGD)

- Swedish Krona (SEK)

- Swiss Franc (CHF)

- Thai Baht (THB)

- United States Dollar (USD)

No, you do not. With Cashfree Payments, you will receive your payments in INR in your settlement account with no additional charges or effort for currency conversion.

International payments will be settled into your account in INR after the settlement cycle, and will be credited to your account normally. Payments received via PayPal will be settled by PayPal directly.

Foreign Inward remittance refers to the transfer of money to Indian from anywhere outside India. For example, when you receive money in your Indian bank account from a business or an individual abroad, it is called foreign inward remittance.

Global Collections is a technology payments platform that is built for exporters who want to receive international payments. This solution is recommended for exporters who are dealing in goods or services having invoice value of up to USD 10,000.

Traditionally exporters in India have been receiving payments via SWIFT. With Global Collections solutions, the exporters can get 5 dedicated local accounts - in 4 currencies namely USD, GBP, EUR and CAD and a Global SWIFT Account to accept payments in 30+ currencies.

Payers/importers can make cross border payments as easy as domestic payments by using local rails like ACH, SEPA, EFT and Faster payments and the amount is credited to the respective local collection account.

Exporters can receive these payments in importer's or payer's home currency without the exporter having to open a bank account in foreign countries saving his/her time, effort and money.

You can visit www.cashfree.com/international-payments/international-wire-transfer/ and click on Contact Sales. Please fill in the basic details about your company and Cashfree Payments sales representatives will reach out to you with 24 working hours to help you get started.

Yes. Here is the OPGSP guideline for your reference.

- The facility shall only be available for export of goods and services (as permitted in the prevalent Foreign Trade Policy) of value not exceeding USD 10,000 (US Dollar ten thousand) per transaction. There is no daily or monthly limit on the number of transactions. However, the value of a single transaction should not exceed USD 10,000.

- Where the exporters availing this facility are provided notional accounts (Global Collection Accounts) with the OPGSP, it shall be ensured that no funds are allowed to be retained in such accounts and all receipts should be automatically swept and pooled into the NOSTRO collection account opened by the AD Category-I bank.

- The balances held in the NOSTRO collection account shall be repatriated to the Export Collection account in India and then credited to the respective exporter's account with a bank in India immediately on receipt of the confirmation from the importer and, in no case, later than seven days from the date of credit to the NOSTRO collection account.

Here's the list of purpose codes to be followed for OPGSP transactions.

Have more questions?

Visit our support page* Settlement cycle is subject to bank approval and can vary based on transaction type, business category/model, risk parameters and other factors.

Ready to get started?

With Cashfree collect payments, make payouts, manage international payments and more. Start now by creating your account or get in touch to explore custom solutions.

Easy onboarding

Dedicated account manager

API access