OUTWARD REMITTANCE

Hassle-free and paperless outward remittance

flow of money across borders

in accordance with RBI guidelines.- Completely digital

- 24x7 payment collections

- Control source of fund

- Extremely convenient - pay via your existing bank account

collect payments in INR

via popular Indian payment modes. Collect remitter KYC documents and other details. Integrate Cashfree API with your website or use no-code solution to plug and start collecting payments in no time.Benefits of using

Outward Remittance solution

over the traditional LRS flow

| Capability | Cashfree Payments | Traditional LRS approach |

|---|---|---|

| Modes of payments | Net-banking via 38+ banks & UPI Payments (Industry-first) | Wire Transfer |

| Remittances | Individual and consolidated remittances | Only individual remittance |

| Remit from your own bank account | User is required to have a current account from the remitter’s bank | |

| Completely paperless | ||

| Same day remittance* | ||

| Native integration for your website or app | ||

| TCS calculation | Real-time calculation before remittance | Manual calculation to be done before remittance |

| FX-rate calculation | Smart FX-rate calculation to fulfil complete payment after currency conversion | Manual calculation of FX rates |

| Real-time status of remittances |

*All payments made before 1PM IST will be settled to the beneficiary account on the same day

Outward Remittance solution

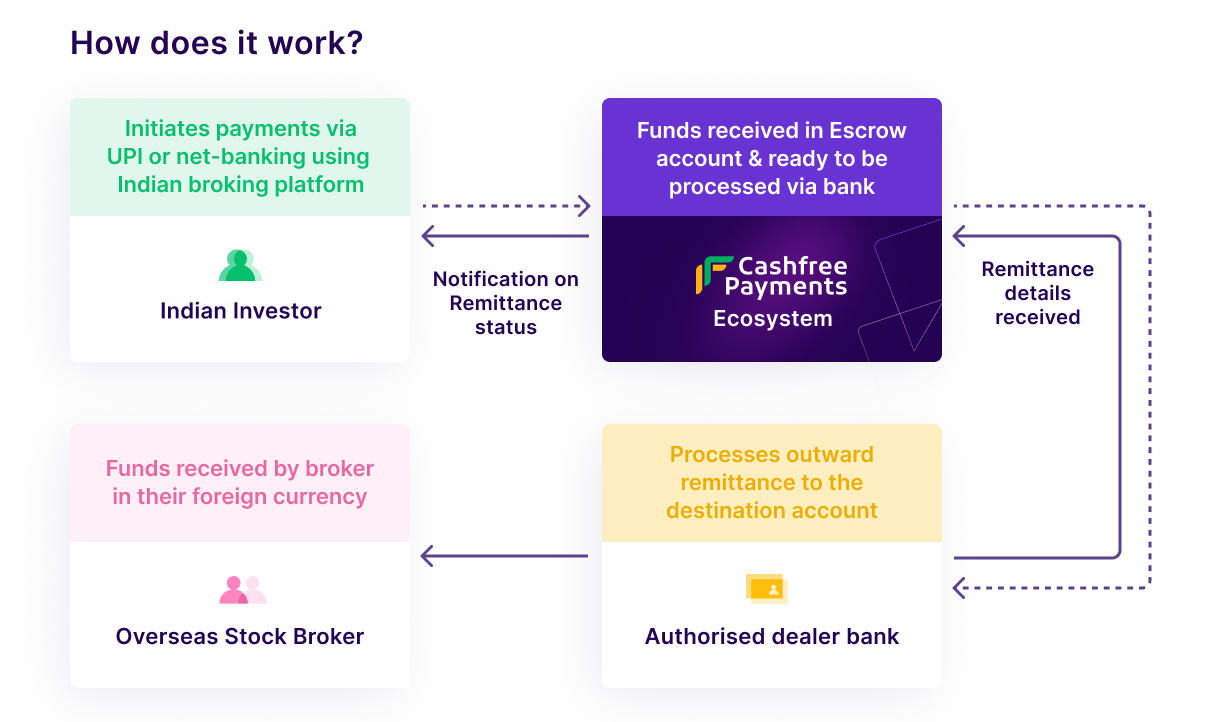

Brokerage firms facilitating international equity investments

International stock brokers and agencies

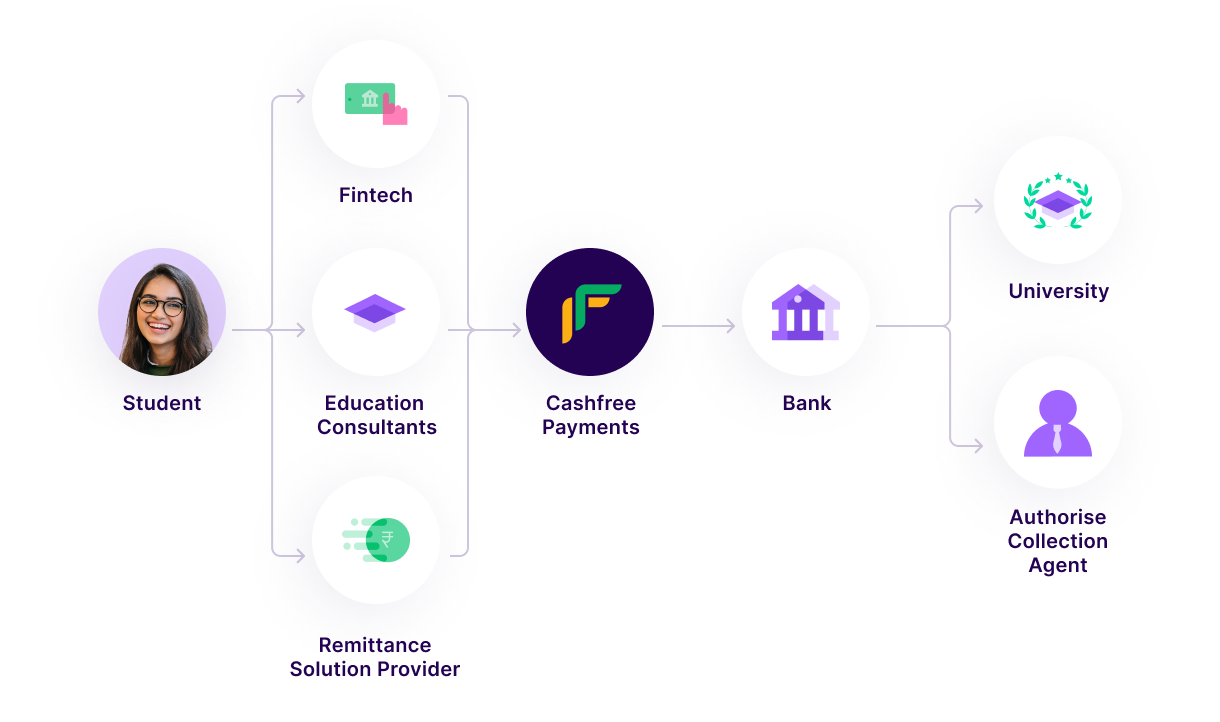

Education consultants based in India for study abroad programmes

Foreign universities/ Authorized collection agents

Remittance service for individuals for travel, study and family payments

International Online Travel Agencies

International Hotels and Destination management companies

International Airlines

Talk to our payments expert now

Have more questions?

Visit our support pageOutward remittance is the process of money transfer from India to any foreign country for purchasing goods, services, or for the purpose of studying, traveling, or investing abroad.

According to RBI’s Liberalised Remittance Scheme, all Indian individuals are allowed to freely remit up to USD 2,50,000 per financial year to any current or capital account transaction, towards study abroad, family maintenance, business/leisure travel or foreign investments.

With single API integration, Cashfree Payments support both LRS Capital and LRS current remittances, including investment, education, travel, family maintenance, etc. We also offer no-code solution for SMEs to plug and start immediately.

With Cashfree solution, Investors can use their existing bank account to invest in foreign stocks, payment can be done through 38+ banks via Net Banking and UPI; traditional ways restrict investors to invest foreign stocks through AD banks they are holding accounts with, or require investors to open new bank accounts.

Cashfree solution digitized the LRS compliance requirements, including A2 form, TCS collection, LRS limit checks; investors may need to sign on physical copy of A2 form and wait for AD banks to confirm TCS amount.

Cashfree solution can complete the remittance in 24 hours.

Have more questions?

Visit our support pageReady to get started?

Collect customer payments, make payouts, manage international payments and so much more. Create your account or contact our experts to explore custom solutions.

Easy onboarding

Dedicated account manager

API access