Table of Contents

An Integrated Payment System is software that integrates with your ERP and allows you to accept payment, making reconciliation easy.

It automatically maps every transaction (or customer order) to a particular payment ID. In other words, it matches every receipt to its respective invoice which is generated automatically. This eliminates the need to go back to the business database and cross-check every transaction.

This is why most businesses choose to use integrated payment systems (otherwise called payment gateways).

Here is a simple analogy. Let’s assume you go out shopping and save every receipt of your spending at different outlets. Later, you go home and cross-check every receipt to your payments application.

OR

Your payment application keeps track of your transactions at every outlet.

The latter–is exactly how an integrated payments system works.

Apart from the obvious time and resource-saving, it eliminates the chances of human error and provides tailored payment analytics.

But of course, there is a lot more to that. In this blog, we will try to understand how an integrated payment system works, its benefits and how you can choose one that suits you.

Do You Need an Integrated Payment System?

The Indian eCommerce market grew by 36.8% in 2022. In fact, statistics project that the online retail market size will reach 350 Billion USD by 2030.

As more and more companies take the digital route, the demand for payment systems will grow. Naturally, easy reconciliation of those payments is equally important. It helps companies maintain their cash flow and project their future growth.

On that note, let’s have a look at some other advantages of integrated payment systems.

Comprehensive Reports- Showing The Full Picture

Not all payments are successful.

A pending order can have multiple failed payments and initiated payments. A successful order can also have multiple failed and initiated payments and only one successful payment.

Now, a merchant’s system or ERP may only keep track of the successful orders and attempted orders. However, an integrated payment system can help you get the full picture. It can help you track all the successful, failed, and initiated payments.

But how will a comprehensive report help you out? Well, it can help you figure out the reasons behind payment failures. A payment failure may be because of non-optimization for mobile pages, security concerns or technology failures.

A comprehensive payment report can help you identify patterns and zero in on the reasons for payment failures. Rectifying that issue can result in higher transaction success rates for your business.

Enhanced Security

Manual reconciliation and accounting are security risks. Cross-checking payments with a physical database is nearly impossible if you have large amounts of transactions.

However, the biggest risk is that of security. Customers’ payment information like credit card details or VPA in UPI is confidential. Integrated payment systems are PCI-DSS compliant so they can process payments. Moreover, they encrypt or tokenize customers’ payment information in order to transfer info to Acquiring banks. On top of that, certain payment gateways employ robust risk and fraud management systems

However, the same cannot be said about a merchant’s database or ERP. They may be susceptible to data breaches and other security concerns.

Moreover, these cloud-based payment systems have their own servers. So, merchants do not have to worry about administration and security maintenance costs.

Another lesser-known risk is that of natural disasters. Fires, floods or other incidents may lead to unprecedented damage to physical databases. On the other hand, integrated payment systems are usually cloud-based gateways. This shields them from the effects of physical damage.

End To End Automation- No Human Error

If you are manually cross-checking each customer transaction, you would need to save each transaction receipt. Then you would have to match each transaction to an invoice. Thereafter, you would have to match the electronic invoice to its physical copy. Finally, you would have to adjust your general ledger.

Thankfully, an integrated payment system takes this hassle away.

As soon as the customer payment is completed, the payment system updates the dashboard in real time. Moreover, each transaction has its own order ID. So, you can search for orders by their unique transaction reference numbers and check the transaction history.

Above all, automation eliminates the chances of human error. Manually mapping invoices to receipts may lead to confusion. This situation can be further exacerbated in case the customer asks for a refund.

92% of customers choose to shop if the refund process is easy. However, refunds can be a huge pain when it comes to reconciliation. Your ERP system may need a manual mapping of each refund to the respective customer order. However, integrated payment can make this process a breeze.

It can help you reconcile refunds and further filter them by time, status and order ID. Moreover, it will provide you with accurate details about the payment method and refund amount.

Real-Time Reconciliation

Reconciliation is the process of verifying your business expenses and income. Now, this can either be done through manual cross-checking with ERP or directly through the payment system.

Naturally, manual reconciliation will be a delayed process. On the other hand, an integrated payment system can give you faster updates about each transaction. It can inform you if the transaction is pending or successful.

However, a modern payment system can go one step further with Real-Time Reconciliation.

Now, the payment processing cycle includes a lot of players. There is the Acquirer, Issuer, Payment Processor, Payment Gateway (aka Payment System) and the Card Network. Now, there can be an issue with any of these players resulting in a delay in reconciliation.

However, this delay can lead to payment uncertainty, or worse, loss of business. For instance, let’s assume that you operate a travel agency. You can only finalize the booking after you have payment confirmation. However, a customer may want immediate booking confirmation. In absence of confirmation, they may resort to cancellation. In this case, a payment system with real-time reconciliation will help.

Real-time reconciliation provides a definitive transaction status within 10 minutes or 1 day. So, a merchant can decide whether the product/service can be offered to the customer. Moreover, a payment system can automatically refund the customer’s funds in case of payment failure. The merchant would not need to pay Merchant Discount Rate for failed transactions.

Moreover, this is beneficial for the customer as well. A lot of times, the funds are deducted from a bank account but the order may not be successfully placed. Now, the customer may be confused between placing a new order or waiting for payment confirmation to show up.

With Real-time reconciliation, customers are aware of their transaction status. They can take their next steps taking that into consideration.

Merchant Friendly UX

Integrated payment systems eliminate the need for painstaking cross-verification. Moreover, they make it easy to search for any particular transaction or batch of transactions within a time period.

To understand just how convenient an integrated payment system is, let’s have a look at its reconciliation process:

After the payment is received from the bank, the payment system credits funds to the merchant account. This step is known as the settlement.

- Settlements can be instant or standard. In the case of standard settlement, you as a merchant can access funds within T+2 days. However, instant settlements can let you access funds within 15 minutes. Either way, you can track all your settlements on the dashboard.

- Then you can apply filters on the dashboard to reports for specific settlements. You can check if the transaction is completed, ongoing or stalled.

- Every transaction has a unique reference ID that can be used to track it.

Furthermore, integrated payment system providers offer reliable support as well. Merchants can avail of live chat for any concerns related to their systems. A dedicated account manager can further help in integrating and using the payment system.

Payment Analytics

However, it doesn’t end there. An integrated payment system can also provide you with accurate analytics for your transactions.

For growing businesses, this is extremely important. After all, business growth and scalability depend on current cash flow. Accurate payment analytics can help you keep track of that. Moreover, it can help you make educated decisions based on your insights.

For instance, your payment system can help you access these insights:

- Payment modes used by customers (net banking, cards, UPI, wallets, etc.)

- Payment volume

- Transaction Date and time

- Platforms used by customers (iOS, Android, etc.)

How To Choose an Integrated Payment System?

Online transactions amounted to over 1.7 quadrillions INR in 2022 in India. Needless to say, an integrated payment system is the need of the hour.

As a merchant, you need to provide the best payment experience to your customer. In addition to that, you need to ensure that the payment system is strategically helpful to your business.

So, let’s have a look at how you can choose an integrated payment system that caters to your business needs.

Payment System is Easily Integrated into ERP

A payment system can be integrated with your ERP for web and mobile applications. Try to go for a payment system that provides detailed integration guides in all major computer languages.

Also, smartphones are the most popular point of access for online banking in India. So, ensure that your payment system provides SDKs for all major mobile operating systems like Android, iOS, ReactNative, Cordova, etc. Furthermore, having ready-to-use plugins for popular eCommerce platforms like Shopify, Magneto and Woocommerce can be a big plus!

Related Read: Test cases for payment gateway

Comprehensive Payment Support

There are a lot of factors that you need to consider before integrating a payment system. However, this, without a doubt, is one of the most important points.

Integrating multiple payment gateways is not feasible for most businesses. Hence, try to go for a payment system that provides all the popular payment modes. This can include cards, net banking, UPI, wallets, EMI and a lot more. This will lead to lower cart abandonment rates and hence, increased sales for you.

Moreover, ensure that your payment system offers international payment support as well. This will ensure that you don’t miss out on overseas sales. Advanced payment gateways will let your customers see product prices in their preferred currencies. In addition to that, it will allow you to settle funds in INR.

Hosted or Non-Hosted Pages

86% of customers state that they will pay more for a better customer experience. As a merchant, you must provide the optimal payment experience to your customers. Hosted or non-hosted payment pages can play a huge role in that.

Hosted payment pages are provided by the payment services provider (PSP) They require the customer to redirect to another page to enter payment information. Here, the PSP is in charge of PCI-DSS compliance.

In non or self-hosted pages, the customer is not redirected. Instead, they stay on the merchant’s site. However, the merchant has the added responsibility of encrypting or tokenizing the customer payment information.

Furthermore, hosted payment pages are far easier to integrate. Taking all points into consideration, you can decide which type of payment page suits your business best.

Related Read: Hosted Payment Gateway

Sub Merchant Account

A merchant account is a business bank account. Without it, you cannot accept or disburse payment. There are two ways to get a merchant account.

- ISO Merchant Account- These are merchant accounts issued directly by association member banks. ISO merchant accounts have their own processing rates and require an enormous amount of resources. This does not include the legal and compliance issues attached to them.

- Sub Merchant Account- Your payment system can also provide you with a merchant account. However, this will be a sub-merchant account mapped to their master account. The payment system will accept the payment on your behalf and settle them after a period of time.

Related Read: Payment Gateway vs Merchant Account

Usually, large multinational enterprises use ISO merchant accounts. On the other hand, a sub-merchant account is best suited for small, medium and large businesses. Most importantly, they are scalable for fast-growing businesses.

How to Integrate Online Payment System in Website

After understanding the basics of an integrated payment system, we move on to the next topic.

How can integrate a payment system into your website?

Well, you have four major ways to do that: Web, Mobile, API integration and eCommerce plugins.

They all have different integration steps so let’s jump right in.

Web Integration of Payment Systems

You would require integrations for your website as well as your mobile application. But first, let’s start with the former.

The first step is to decide the kind of payment page you require. A hosted page will require a slightly different integration than a self-hosted one.

Cashfree Payments offers you three kinds of integrations:

Standard Checkout: Here, the customer is redirected to a payment page maintained by the payment system. The PSP takes care of PCI compliance and safely encrypts the payment information. Head here to check out the integration for Standard Checkout.

Seamless Basic: This is a self-hosted payment page where the customer stays on the merchant’s website. However, they enter their payment information on an embedded form maintained by the payment system. Click here to check out the integration steps for Seamless Basic.

Seamless Pro: In this type of integration, the customer payment information is collected by the merchant. They forward this information to the payment system for payment processing. Here, the merchant is responsible for being PCI compliant. Head here to check out the integration for Seamless Pro.

Mobile Integration of Payment Systems

Now, it is important to note that different mobile operating systems have different integration steps for a payment system.

Ensure that your payment system provides detailed integration guides to these platforms. Cashfree Payments provides integration support for these platforms:

- Android SDK

- iOS SDK

- React Native SDK Version 2.0.0

- React Native SDK Version 2.1.0

- Flutter SDK

- Cordova SDK

- Android Support SDK: Xamarin

- AndroidX SDK: Xamarin

- iOS SDK: Xamarin

- Xamarin Forms SDK

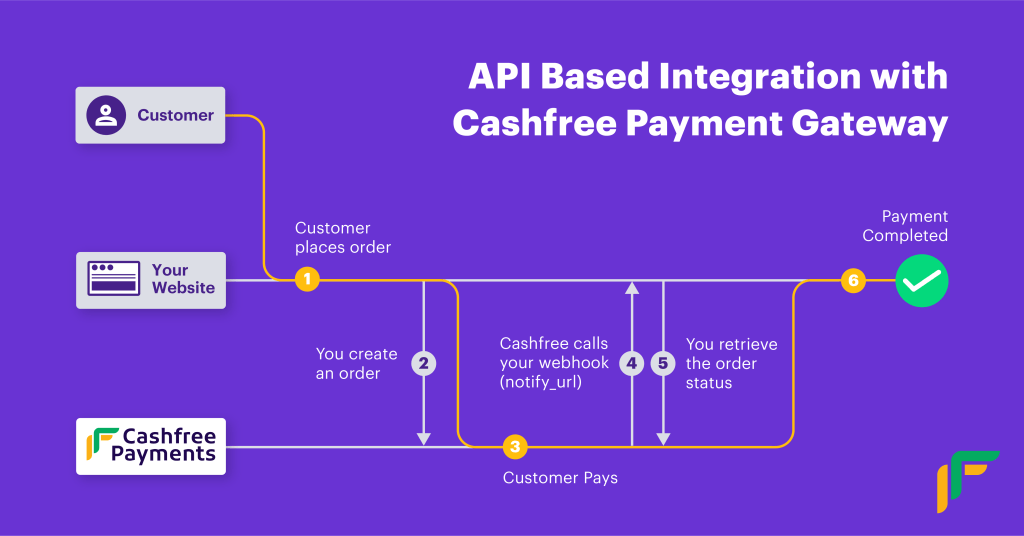

API based Integration

The API-based integration is extremely developer-friendly, taking less than 30 minutes.

Here, the merchant can either use the pre-built checkout page or create a custom page using the APIs.

Check out the details for the Cashfree Payments API integration here.

E-commerce Platform Plugins

Finally, we have the eCommerce platform plugins. They help you easily integrate and accept payments for your website on eCommerce platforms.

You need to install the plugin and enter your app id and secret key. The appID and secret key are provided after you onboard with the payment system.

The plugins redirect your customers to the payment system’s hosted payment form. Cashfree Payments offers plugins for these eCommerce platforms:

Related Read: Payment Systems For eCommerce

Conclusion

Phew!

We’ve finally reached the conclusion of this guide.

Choosing an integrated payment system may not be a piece of the cake. However, we hope this blog helped you understand the features you may need from a payment system.

Do you think we missed out on any features? Let us know your thoughts in the comments below!